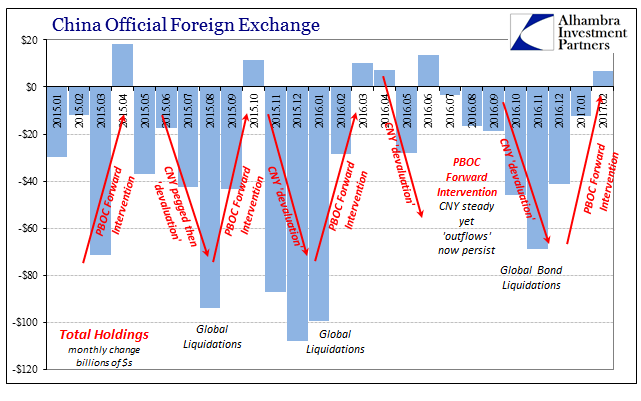

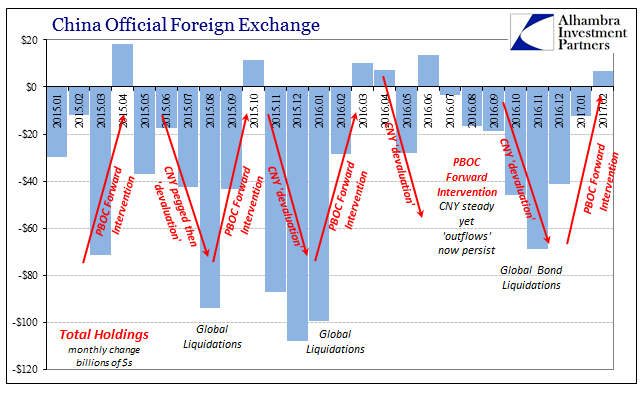

The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece. Yet, each and every time the delta pushes positive there is the same analysis as if anyone was prevented from reviewing the history so as to very easily see the regularity by which all this happens.

From the WSJ:

China’s foreign-exchange reserves rose last month for the first time in eight months due to Beijing’s concerted effort to stanch capital outflows as well as valuation changes in the stockpile’s assets.

That is almost always the interpretation, when reserves flash positive (and not even positive but also a lower negative) it must be due to the skill and precision of China’s much admired central bankers. From CNBC:

China has tightened rules on moving capital outside the country in recent months as it seeks to support the yuan currency and stem a slide in its foreign exchange reserves.

I wrote in early October 2015 when China’s assumed “outflows” merely dropped by half from the catastrophic level reached that August that mainstream commentary was setting itself up for this very repeated miscalculation.

In any situation where banks are funding “dollar” positions on a client’s behalf triggers this reserve; the transactions where the client is providing “dollars” to banks are not. Looking at that factor from the bland, orthodox perspective might lead to “curbing the yuan’s depreciation” as a reason for the peculiar arrangement here, while the wholesale view suggests a multi-layered tactic to suppress difficulties within China’s end of the global “dollar” short.

For one, it seems to have worked, at least for the month of September. While China still reported dollar outflows, -$43.26 billion, they were far less than anticipated and less than half of what was reported in the amazing “run” of August (-$93.9 billion). Predictably, that has led already to pronouncements that “it” is “over.”