Wednesday begins in China, where we got highly anticipated trade data that probably shouldn’t have been so highly anticipated given that seasonality makes the compare largely meaningless.

But you know, whatever. Here’s the breakdown:

And here’s the version that’s not all in caps (via Bloomberg):

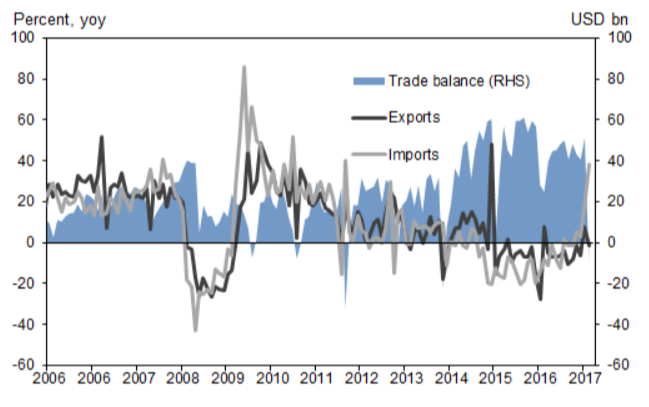

So that’s the first deficit in three years. In USD terms the picture looks like this:

(Goldman)

Seasonality aside, this makes for an interesting compare with yesterday’s FX reserve data which showed Beijing’s war chest rising back above the psychologically important $3 trillion mark. Here’s a bit of commentary from Goldman:

Over the past ten years there were only six monthly trade deficits and half of them occurred in February (the other half in March). The only year with two months of deficit was 2011 when the economy was overheated. We are not expecting that to occur this year and March trade balance is likely to turn positive. All else equal, the weaker trade balance would be expected to put downward pressure on the currency, although recently released data suggests foreign reserves were stable in February.

Right. And indeed at least one bank estimates that the intervention effect last month was the most positive since February 2015 (read: before the proverbial sh*t hit the fan in August of that year):