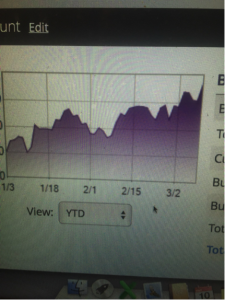

On January 3, 2017 I offered readers and investors my plans for continued triple digit returns on capital invested in 2017. The article My Plans For Success In 2017 Continue To Involve VIX-Leveraged ETFs/ETNs served to outline how I would continue to allocate roughly 20% of Golden Capital Portfolio investable capital in shares of ProShares Trust Ultra VIX Short-Term Futures ETF (UVXY), VelocityShares Daily 2x VIX ST ETN (TVIX) and/or iPath S&P 500 VIX Short-Term Futures ETN (VXX). Since this publication, some of these instruments have executed a reverse split with TVIX set to execute a reverse split in the coming days. Additionally, since January 3rd, I have reduced my capital exposure to UVXY shares. Entering the year with 20% of capital outlays in UVXY short positions, I have reduced this core position to 15.4% within the Golden Capital Portfolio. The first reduction came at $26.90 a share and the next reduction came at $19.05 a share. Even with this curtailment of exposure, I have managed a series of short trades to accommodate for any would be loss of gains from the $26.90 to $19.05 share price decay. Many of these trades are posted in real time through my Twitter feed. Alongside these various trades I offer an up-to-date snapshot of Golden Capital Portfolio performance as depicted below:

After capturing a 167% return on capital deployed in 2016, FY17 is on track to eclipse 2016’s returns. Year-to-date, Golden Capital Portfolio is up 41.2% with a couple of weeks still to go in March/Q1. While shorting Vix-leveraged instruments has and continues to be the key drivers of success for Golden Capital Portfolio, picking the right stocks and managing the investment has also proven to bolster the portfolios performance. As an analyst covering the retail sector, picking a good retail investment has been quite the obstacle. But as I outlined in November of 2016, Costco (COST) would likely achieve new all-time trading highs based on the retailer’s fundamental performance and moat around its business. In the article titled Costco Shares Have Been Poorly Received By Investors, I alerted investors to my stake in the company as well as my outlook for share price appreciation. Having added this position at $144 a share to Golden Capital Portfolio, taking a hefty profit at $154 and in February at $176 proved wise. In February, shares of COST did reach an all-time trading high for which I alerted investors/traders and followers to my decision for taking profits on Stocktwits as depicted below.

What would be optimal and as I’ve thoroughly reviewed Costco’s most recently reported results, is if shares were to retrench back to $160-$163. It’s in that price range that I would begin considering to recapture my previous share ownership level. Investors witnessed Costco report a miss on the top and bottom line in their Q2 2017 results. Having said that, the revenue miss was slight, even as the company grew sales 5.7% year-over-year. The headwinds surrounding profits haven’t alleviated in 2017 with gas price deflation and currency headwinds ever-present. But within the Costco business model also remains the ability for the retailer to leverage it’s membership fees. It’s been roughly 5 years since Costco raised its membership fees and as such, the company outlined its plans to do so in 2017.