Discount retail giants Wal-Mart Stores (WMT) and Target (TGT) are both on the list of Dividend Aristocrats.

The Dividend Aristocrats are a group of 51 companies in the S&P 500 with 25+ years of consecutive dividend increases.

Wal-Mart and Target have raised their dividends for 44 and 45 years in a row, respectively.

With such long histories of steady increases, they have proven the ability to navigate the ups and downs of the retail industry.

This is an especially challenging period for both Wal-Mart and Target. Their core brick-and-mortar business models are under fire, from e-commerce sites like Amazon.com (AMZN).

Wal-Mart and Target are working hard to catch up in e-commerce, while continuing to reward shareholders with steady dividend raises.

Even though it might sound crazy, Wal-Mart’s quicker turnaround actually makes Target the better investment right now.

Business Overview

Winner: Wal-Mart

Wal-Mart has an edge over Target, because it is more diversified. Wal-Mart operates more than 11,000 stores, both in the U.S. and in the international markets.

Target operates exclusively in the U.S., after closing its stores in Canada.

In addition, Wal-Mart owns a warehouse club, under the Sam’s Club banner.

Wal-Mart is organized into three operating segments:

Wal-Mart’s international business provides it with an advantage over Target, because it opens up new avenues for growth.

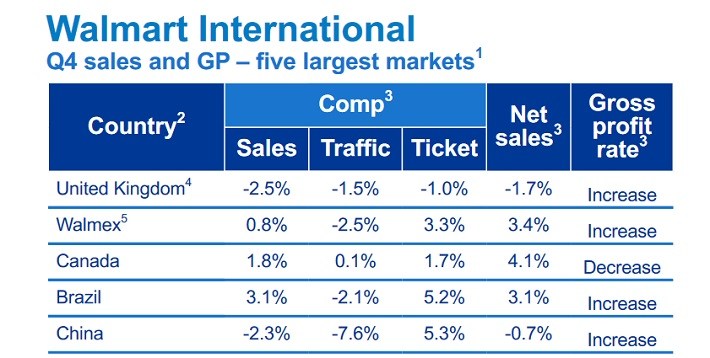

Source: 4Q Presentation, page 9

Wal-Mart saw strong growth in Canada, Mexico, and Brazil in the fourth quarter.

Excluding the impact of foreign exchange, Wal-Mart’s international segment grew net sales and operating profit rose 3.0% and 3.8%, respectively, last fiscal year.

10 of Wal-Mart’s 11 international markets posted positive comparable sales last year, seven of which grew comparable sales by more than 4%.