What a difference a quarter makes! As I said one-quarter ago:

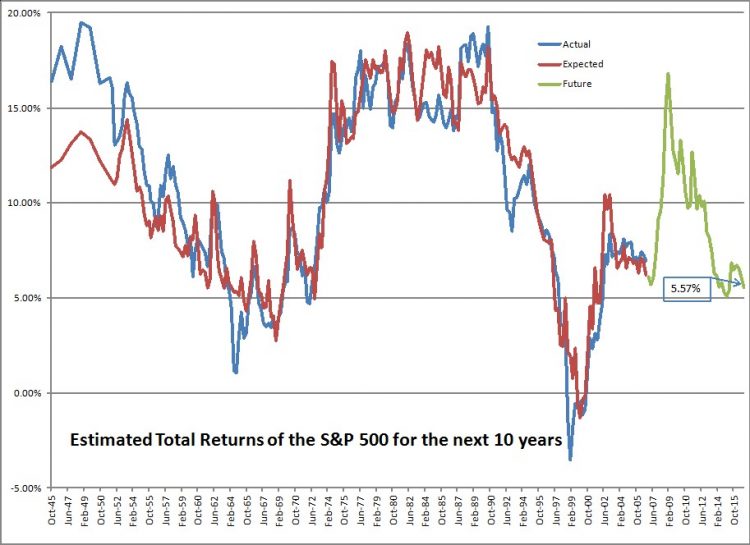

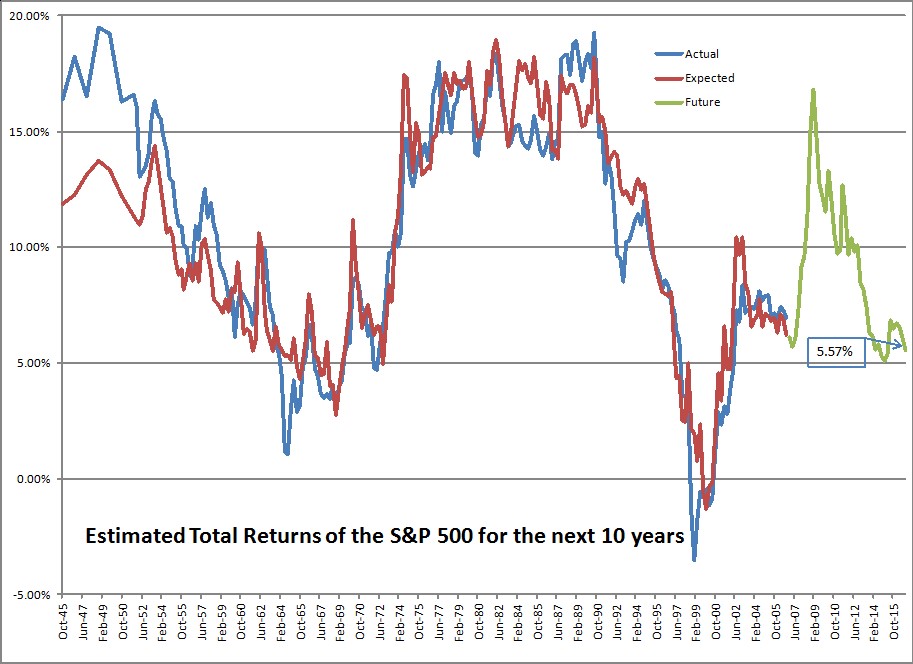

Are you ready to earn 6%/year until 9/30/2026? The data from the Federal Reserve comes out with some delay. If I had it instantly at the close of the third quarter, I would have said 6.37% — but with the run-up in prices since then, the returns decline to 6.01%/year.

So now I say:

Are you ready to earn 5%/year until 12/31/2026? The data from the Federal Reserve comes out with some delay. If I had it instantly at the close of the fourth quarter, I would have said 5.57% — but with the run-up in prices since then, the returns decline to 5.02%/year.

A one percent drop is pretty significant. It stems from one main factor, though — investors are allocating a larger percentage of their total net worth to stocks. The amount in stocks moved from 38.00% to 38.75% and is probably higher now. Remember that these figures come out with a 10-week delay.

Remember that the measure in question covers both public and private equities, and is market value to the extent that it can be, and “fair value” where it can’t. Bonds and most other assets tend to be a little easier to estimate.

So what does it mean for the ratio to move up from 38.00% to 38.75%? Well, it can mean that equities have appreciated, which they have. But corporations buy back stock, pay dividends, get acquired for cash which reduces the amount of stock outstanding, and places more cash in the hands of investors. More cash in the hands of investors means more buying power, and that gets used by many long-term institutional investors who have fixed mandates to follow. Gotta buy more if you hit the low end of your equity allocation.

And the opposite is true if new money gets put into businesses, whether through private equity, Public IPOs, etc. One of the reasons this ratio went so high in 1998-2001 was the high rate of business formation. People placed more money at risk as they thought they could strike it rich in the Dot-Com bubble. The same was true of the Go-Go era in the late 1960s.