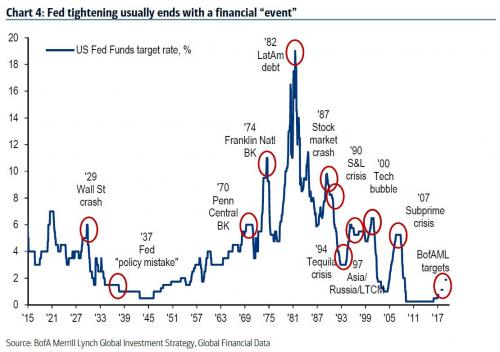

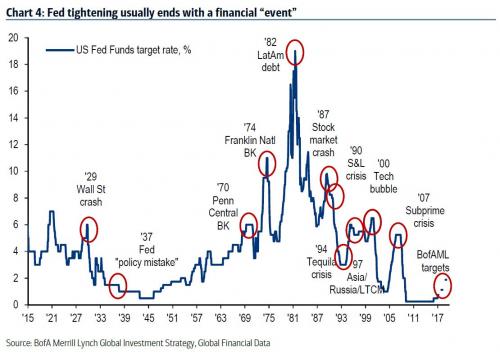

Last week, in an abrupt shift to his bullish posture, Bank of America strategist Michael Hartnett laid out how he envisioned the transition from the current “Icarus” rally to what he dubbed the market’s “Great Fall” – or “Humpty Dumpty” trade – which he expected to take place in the second half of the year, and which he said would be precipitated by another downward inflection in EPS, but more importantly, a more hawkish Fed. Specifically, he showed a chart which revealed that historically, once the Fed starts tightening, it keeps tightening until there is a “financial event.”

Overnight, in his latest webcast to DoubleLine investors, Jeffrey Gundlach echoed Hartnett, when he said that he expects the Federal Reserve to begin a campaign of “old school” sequential interest rate hikes until “something breaks,” such as a U.S. recession. As we noted yesterday, Gundlach – who does not believe a recession is imminent – said that U.S. economic data support a rate increase as soon as the next Fed policy meeting next Wednesday, and further rises this year after a series of false starts in 2015 and 2016, .

“Confidence in the Fed has really changed a lot,” Gundlach said on an investor webcast quoted by Reuters. “The Fed has gotten a lot of respect with the bond market listening to the Fed” now that economic data support the tough rhetoric from Fed officials.

As Reuters notes, it was not so much Yellen but Dudley who gave markets an initial jolt last week when in a television interview he said that “animal spirits had been unleashed.” Dudley also said the case for tightening monetary policy “has become a lot more compelling” since the election of President Donald Trump and a Republican-controlled Congress.

To validate the Fed’s upcoming decision, which faces just one hurdle this week in the face of the February payrolls report on Friday, Gundlach said on the webcast that inflationary pressures are increasing as well as business confidence, which will translate into a stock market that will “grind higher.” But Gundlach, who previously was far more skeptical on stocks, repeated his warning Tuesday that U.S. stocks are not cheap, and added that he holds Treasury inflation-protected securities and gold against this economic backdrop.