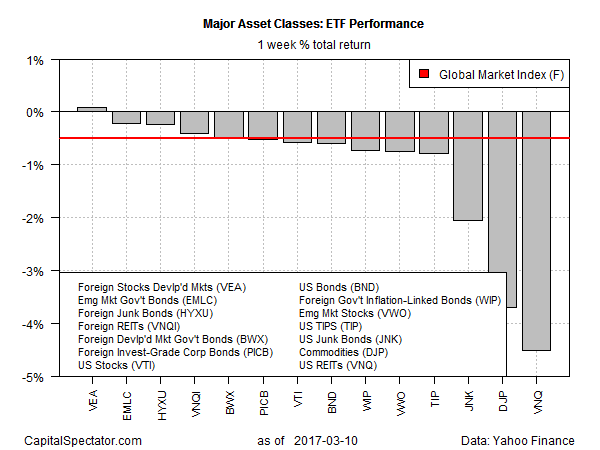

Red ink spilled across nearly every corner of the global markets last week, based on a set of exchange-traded products representing the major asset classes. The lone exception: foreign stocks in developed markets in US dollar terms. Otherwise, losses took a toll far and wide.

Vanguard FTSE Developed Markets (VEA) bucked the trend, posting a slight gain of 0.1% for the five trading days through Friday (Mar. 10). The advance pushed the fund near its highest close since the summer of 2015.

Last week’s biggest loser: real estate investment trusts (REITs) in the US. Vanguard REIT (VNQ) fell a hefty 4.5% last week. Weighed down by the expectations that the Federal Reserve will raise interest rates this week, the yield-sensitive REIT fund closed at its lowest price of the year so far.

Last week’s downside bias delivered a loss for an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights slid 0.5% last week — its first weekly decline since January.

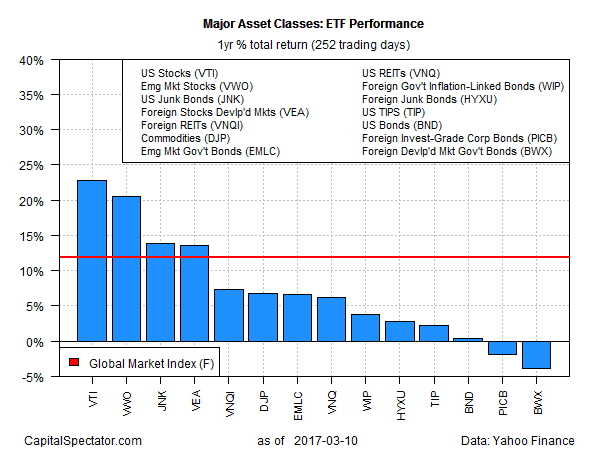

By contrast, one-year results are still mostly positive, but losses began creeping into this previously positive across-the-board profile.

Leading the field higher over the past 12 months: US equities. Vanguard Total Stock Market (VTI) is up 22.7% in total return terms for the year through Mar. 10.

The biggest loss among the major asset classes at the moment: government bonds in foreign developed markets in unhedged US dollar terms. SPDR Bloomberg Barclays International Treasury Bond (BWX) is off 3.8% for the trailing one-year window.

Meanwhile, GMI.F’s one-year trend remains solidly positive over the past year. The benchmark is ahead by 11.9% for the 12 months through Mar. 10.