Everbridge (Nasdaq:EVBG) – Sell or Short Recommendation

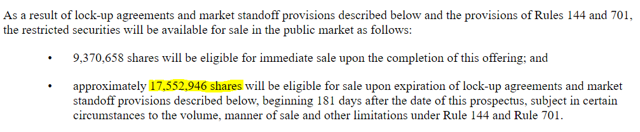

The 180-day lockup period for the Everbridge IPO is set to expire on 3.17. At this time, the company’s pre-IPO insiders will be able to sell 17,552,946 shares, which represent 65% of the total shares outstanding. The sudden increase in shares available for trade could potentially flood the market and lead the share price to fall.

While not all lockup expirations provide short opportunities, Everbridge offers a unique combination of factors, opening a window for event-driven traders.

We suggest shorting Everbridge shares before the lockup period expiration to take full advantage of the impending declines.

(S-1/A Filing)

Business overview: Provider of security solutions and critical software for safety

Everbridge is a tech company that provides enterprise-level software to aid communication for businesses during critical events, such as public threats and disasters. The company’s platform provides immediate news and updates during terrorist attacks, active shooter events, cyber attacks and severe weather incidents. The platform allows millions of messages to be sent simultaneously to 200 countries in 15 languages in near-real-time deliveries. The platform allows users to make threat assessments, aggregate data and deliver contextual information.

Services included are: Mass Notification, Incident Management, IT Alerting, Safety Connection, Community Engagement, Secure Messaging, and Internet of Things. The company has customers in 25 countries. Its customers include eight of the 10 largest U.S. cities, 24 out of the top 25 busiest U.S. airports, eight of the 10 biggest investment banks and four out of the 10 largest health providers in the country, among others. It is based in Burlington, Massachusetts.

IPO and Early Market Performance

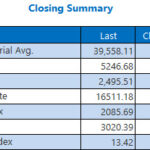

The company priced its shares at $12 on Sept. 15, 2016, which was the midpoint of its marketed range of $11 to $13. During its market debut, Everbridge soared to close at $15.25 for a 27% gain. Since that time, the stock has moved upward, and as of 3/6, shares were trading at $18.04, a 58.7% gain from its IPO price.