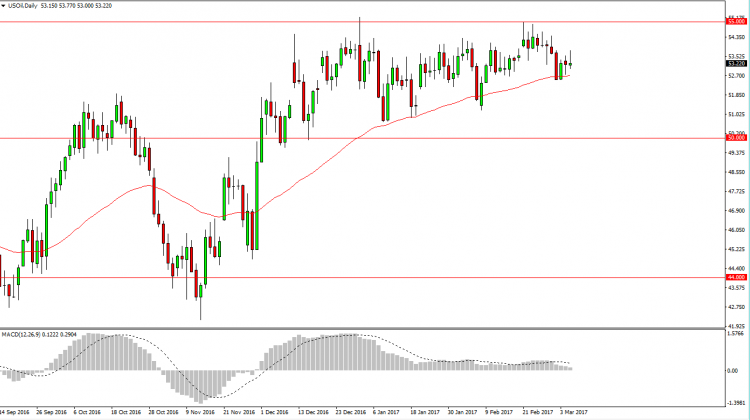

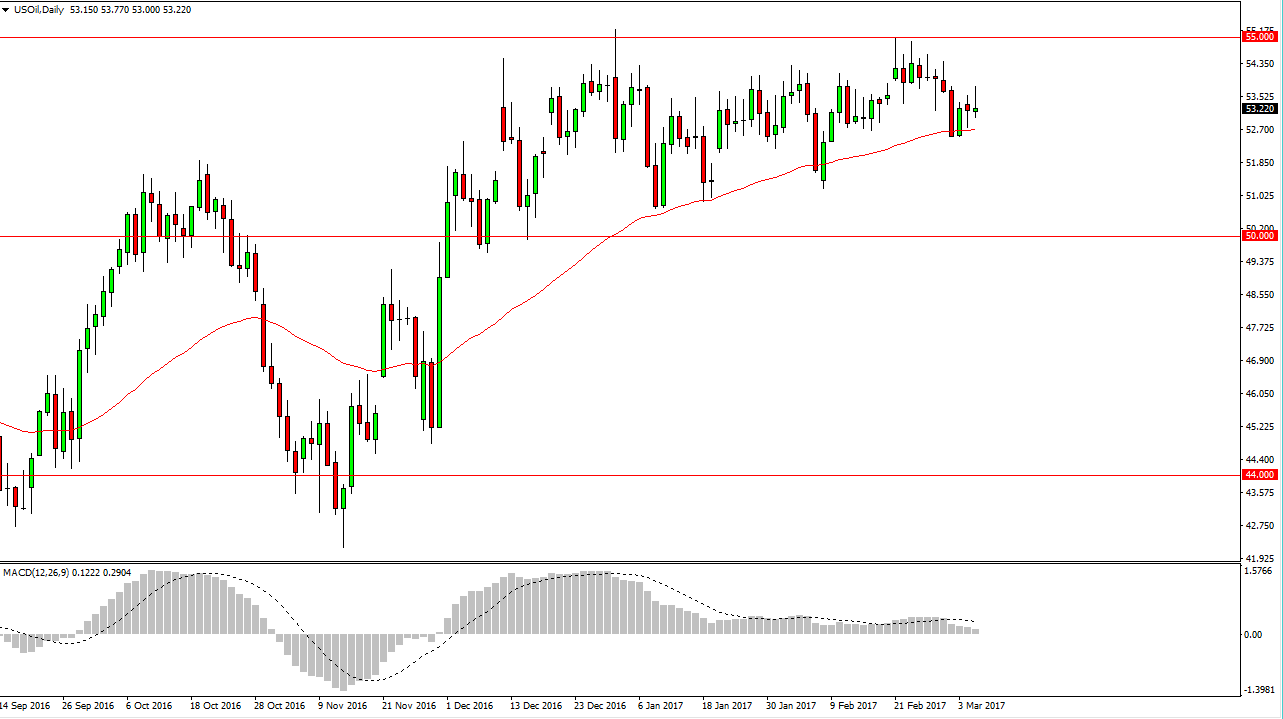

WTI Crude Oil

The WTI Crude Oil market rallied during the day on Tuesday initially, but gave back quite a bit of the gains as we continue to see volatility in this market. It looks as if the area above continues to be resistive, but quite frankly I think that the Crude Oil Inventories announcement will continue to keep the market on its toes, as we weigh the effects of oil output production cuts by OPEC, and of course the oversupply. The announcement today will be crucial, expected to be an addition of 1.66 million barrels. We continue to see a build of inventory, so I feel it’s only a matter of time before the sellers get aggressive. Short-term however, there’s nothing on the sharp suggesting that were about to melt down so I think we could see a “sell the short-term rally” type of attitude.

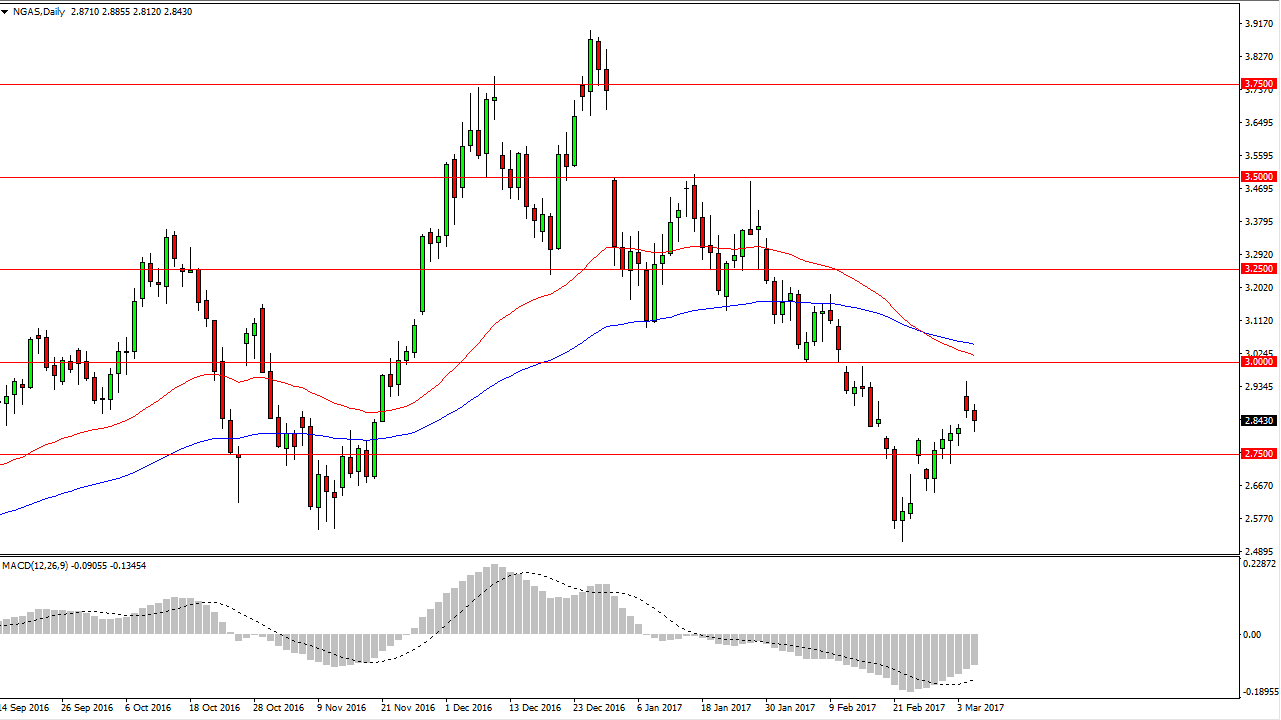

Natural Gas

Natural gas markets fell to fill the gap from the Monday session on Tuesday, but bounced a little bit as one would expect. However, the overall attitude of natural gas is still very negative, and I believe it’s only a matter of time before we see the sellers jump back into the marketplace. I believe that the $3 level above is going to be a massive ceiling, not only because of the large, round, psychologically significant number itself, but the fact that the 50 day and the 100-day exponential moving average that just above it.

I continue to play this market the same way, simply selling rallies as they show signs of exhaustion. I have no scenario in which a willing to buy natural gas currently, as I know that the oversupply continues to be a major problem, and warmer than expected temperatures in the United States this winter have not helped. Ultimately, I believe that the market is going to test the $2.50 level.