Abbott Laboratories (ABT – Free Report) reported first-quarter 2017 adjusted earnings from continuing operations of 48 cents per share, 11.6% higher than the Zacks Consensus Estimate and up 17.1% year over year.

Reported earnings for the quarter came in at 22 cents per share, way ahead of the year-ago number of 4 cents.

First-quarter worldwide sales came in at $6.33 billion, up 29.7% year over year on a reported basis. The quarterly figure also remains ahead of the Zacks Consensus Estimate of $6.11 billion.

On a comparable operational basis (adjusting the impact of foreign exchange, certain acquisitions and divestments) sales increased 3.2% year over year in the reported quarter.

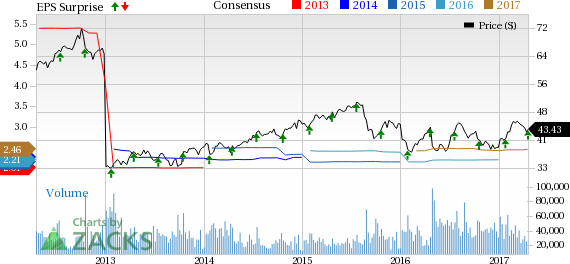

Abbott Laboratories Price, Consensus and EPS Surprise

Abbott Laboratories Price, Consensus and EPS Surprise | ABT

Quarter in Detail

Abbott Labs operates through four segments – Established Pharmaceuticals Division (EPD), Medical Devices, Nutrition and Diagnostics.

EPD sales were up 7% on a reported basis (up 5.7% on comparable operational basis) to $950 billion. There was a positive impact of 1.3% due to currency fluctuations. Sales in key emerging markets increased 15.2% (up 12.5%) driven by commercial initiatives and locally relevant portfolio expansion. Sales in Other segment declined 13.4% (down 11.3%) to $220 million on poor Venezuelan operations.

The Medical Devices business sales spiked 100.2% on a reported basis on St. Jude inclusion to $2.39 billion. However, on a comparable operational basis, sales increased 4.5%.

Cardiovascular and Neuromodulation sales increased 207% on a reported basis (up 2.4% on comparable operational basis) on double-digit growth in Electrophysiology, Structural Heart and Neuromodulation. Vascular product sales were up 0.1% on a comparable operational basis on the back of double-digit growth in MitraClip. Also, strong sales growth in Abbott’s Endovascular business was driven by vessel closure products and Supera.