Fundamental Forecast for GBP: Neutral

The big news out of the U.K. this week came on Tuesday morning from Prime Minister Theresa May, in which she surprised the world by announcing that general elections will be held early, on June the 8th. The move was widely-applauded as astute political strategy from PM May, as she could use this opportunity to cauterize additional support for her Conservative party ahead of Brexit negotiations. Most opinion polls indicate that these snap elections could allow Tories a greater share of Parliament; and that could embolden the nation’s negotiating position when starting Brexit negotiations with the European Union.

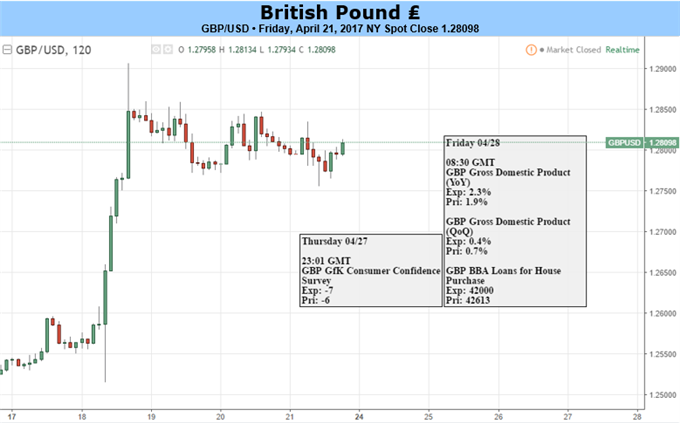

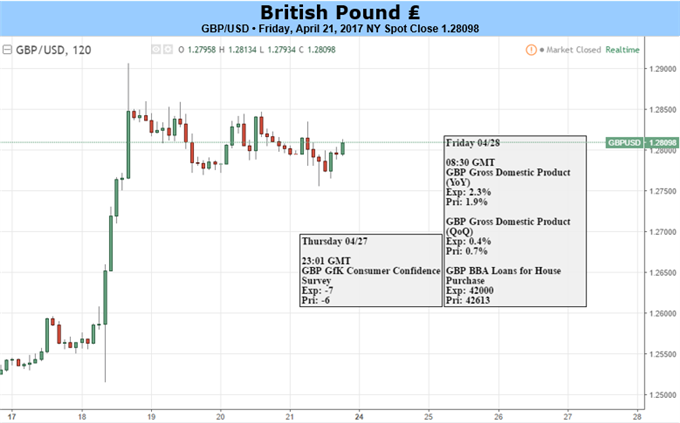

The near-immediate impact of Tuesday’s announcement was a gust of strength in the British Pound, pretty much across-the-board. In Cable, the pair finally broke-above resistance that had set in after the ‘flash crash’ in October at the 1.2775 level; EUR/GBP ran down to the key support zone around .8300 that’s held in the pair since the spike from the Brexit referendum, and even GBP/JPY reversed a string of losses (breaking above a trend-line) that had plagued that market since the December rate hike out from the Federal Reserve. In very short order, many were claiming that PM May’s announcement was a ‘game changer’ for the British Pound and, in-turn, the U.K.

More likely, however, would be that these rapid price gains were elicited from short-covering as yet another dash of uncertainty entered the picture. Investors generally eschew uncertainty by limiting risk: Given the brisk declines in GBP in the post-Brexit environment, this would allude to a fairly-sizable net short position in the market. To close short positions, investors need to buy to cover; and this can create a strong move-higher as new ‘news’ gets priced-in to a heavily-shorted market. As prices run-higher, currently-held short positions are ‘squeezed’ further as those higher prices cutting into equity, creating even more impetus to buy (to cover), thereby creating even-more strength.