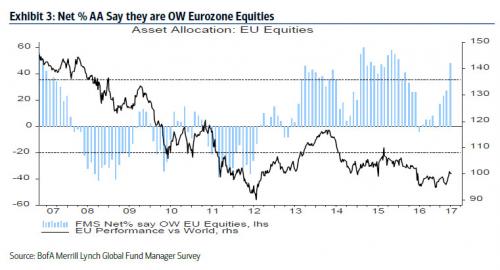

Forget the “great rotation” from bonds into stocks – and certainly when the 10Y dropped as low as 2.175% – a far greater rotation taking place currently is out of the US and into European equities, according to the latest monthly Fund Manager Survey released today by Bank of America.

In it chief strategist Michael Hartnett finds that investor love for Eurozone stocks surges despite imminent French election, making the Eurozone the most favoured FMS global region. As a result, the April rotation to Eurozone stocks from US is the 5th largest since 1999. According to Hartnett, while a Le Pen win means Eurostoxx down 5-10% based on investor polling, fear of EU disintegration “tail risk” dropped sharply in past 2 months.

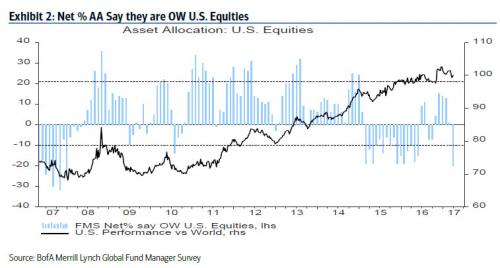

Meanwhile allocation to US equities has slumped to the lowest levels since Jan 2008: among the catalysts for scramble from US are valuation, as “83% of investors say US stocks overvalued, highest on record“, and jump in risk of delayed US tax reform.

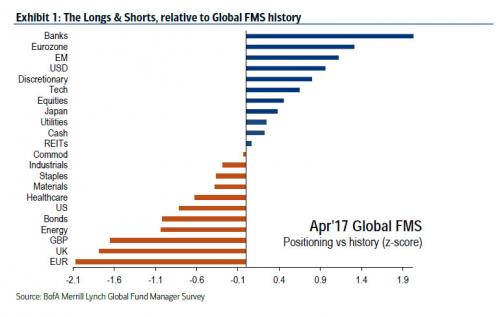

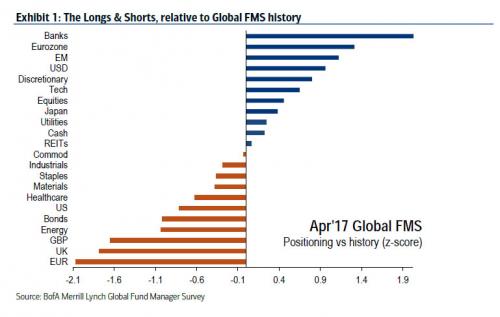

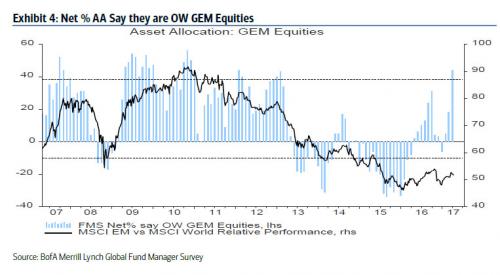

It was not just Europe however: BofA also finds that investors aggressively bought EM stocks (allocations at 5-year highs), and they sold US, and energy & materials sectors; relative to history…

… investors very long banks (FMS allocation to global banks at all-time high), and very short Euro, sterling, UK stocks in April.

* * *

And here are BofA’s Charts of the Month:

Allocation to US equities plunges to 20% UW from net 1% OW last month, the lowest since Jan’08. Current allocation to US equities is 0.8 stdev below its long-term average.

In contrast allocation to Eurozone equities rises to 15-month highs (net 48% OW from net 27% OW last month). Current allocation is 1.3 stdev above its longterm average.

Finally in April, allocation to EM equities jumps to net 44% OW from net 18% UW last month, the highest allocation in 5 years. Current allocation is 1.1 stdev above its long-term average.

* * *

Finally, for those feeling contrarian to the prevailing Fund Manager consensus, here is how to play it according to BofA: