Eight days ago, the stock market looked to be in trouble. The S&P 500 had closed at a “lower low” on the daily chart, the weekly chart was in a downtrend, and the bears were busy telling anyone that would listen it was their time to shine. Pundits were busy pointing out the downside potential and talking about the correlations between 2017 and 1987, 2007, etc. And with the VIX spiking to the highest level of the year, it appeared that some fear had indeed returned to the corner of Broad and Wall.

But then the political landscape abruptly shifted. Donald Trump began insisting on unveiling his tax plan ASAP. And the French Presidential election, which, we were told by our friends who see the market’s glass as at least half empty, was going to be a game changer – and not in a good way. Then the polls opened in France.

To the delight of the markets, both of France’s establishment parties were swiftly booted to the curb and a pro-growth, pro-EU political outsider took the lead. In short, the next European crisis appeared to be over before it began and analysts everywhere started to look at the bright side of the macro picture.

Just like that, Ms. Market’s mood turned from dour to optimistic. Suddenly, the hope trade was back as traders realized that a tax deal might get done sooner rather than later and the European economy might actually be improving.

Speaking of hope, this is exactly what traders appeared to be pricing into the stock market this week. With some big details, such as a 15% tax rate on corporations, being leaked early and often, the thinking was that the Trump tax plan was going to be a winner. After all, with the White House touting their plan as the biggest tax cut in history, it had to be good, right?

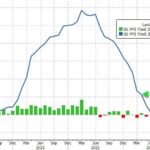

However, once Messrs. Mnuchin and Cohn started unveiling the plan to the public, the stock market took a dive. Take a look at the chart below, which is a 1-minute chart of the S&P 500 yesterday afternoon.