Last week, two important U.S. economic reports were released. What do they imply for the gold market?

Recently, geopolitical events – such as the U.S. strike in Syria, tensions over the North Korea, Turkish constitutional referendum, or May’s call for a snap election in the UK – have caught the investors’ attention. However, geopolitical events rarely lead to lasting rallies. Since the macroeconomic backdrop seems to be a more important driver for gold prices in the long-run, let’s catch up and analyze the recent economic data coming out of the U.S.

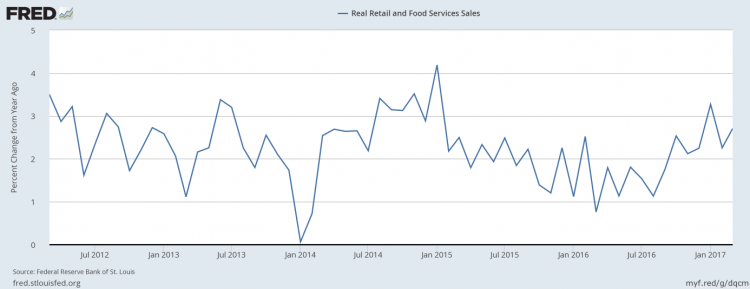

First of all, retail sales declined 0.2 percent in March, falling short of expectations. Moreover, February’s gain of 0.1 percent was revised to a 0.3 percent decline, marking the worst two-month stretch in two years, which does not bode well for economic growth at the beginning of 2017. Indeed, the Atlanta Fed’s GDPNow model forecasts real GDP growth in the first quarter of 2017 at only 0.5 percent after the publication of the retail sales report. Importantly, excluding both vehicles and gasoline, retail sales rose only 0.1 percent.

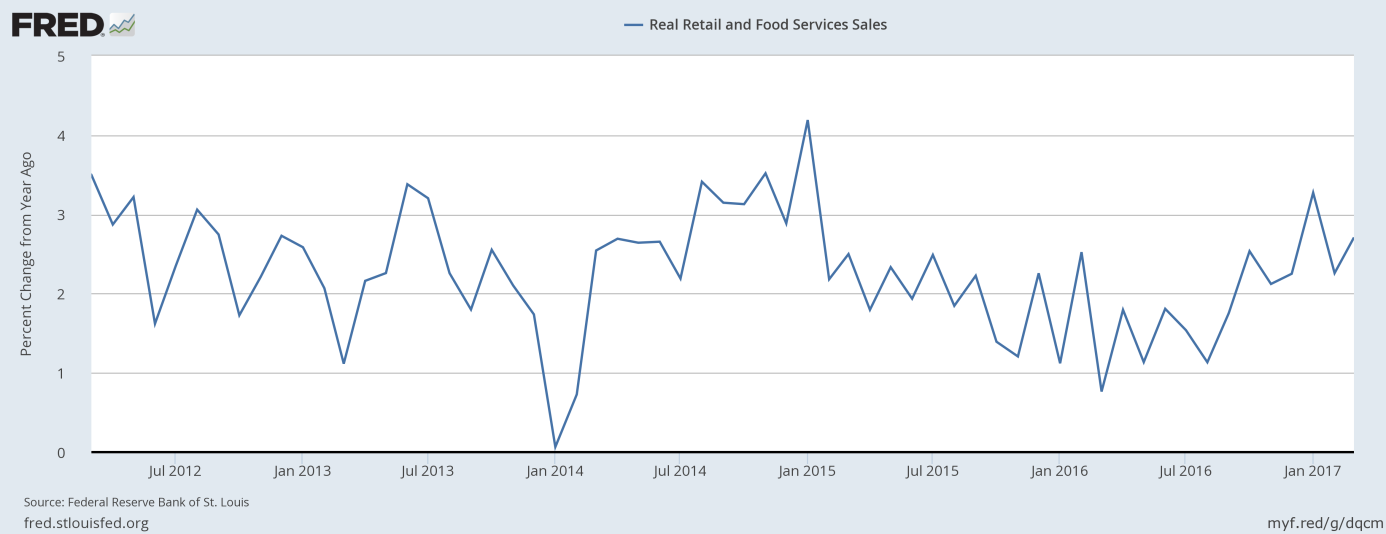

As one can see in the chart below, the annual growth rate in real retail sales has accelerated in the past year, but the long-run trend seems to be less favorable.

Chart 1: Real retail sales year-over-year from March 2012 to March 2017.

Second, consumer prices declined 0.3 percent in March, according to the Bureau of Labor Statistics. It was the first drop in more than a year. Economists polled by Bloomberg had forecast no change. The core CPI, which excludes the volatile energy and food categories, decreased 0.1 percent. On an annual basis, the overall CPI slowed to 2.3 percent, while the core CPI jumped only 2 percent over the last 12 months.

As one can see in the chart below, inflationary pressures softened in March. However, one month does not make a new trend, so there may be a rebound in the near future.