Attempting to predict the outcome of an election is a fool’s errand — we don’t bother with it.

But that doesn’t mean we can’t make money off the vote…

Over the last few weeks we’ve discussed the reasons for the rise of populism and how it’s impacted the false trend in European equities. We explained how these Soros-style false moves are dependent on narrative “tests” that either strengthen the trend or reverse it. In Europe’s case, its narrative test is arriving in the form of French elections.

This year’s elections are pivotal because the French are dangerously close to electing a populist, anti-euro candidate named Marine Le Pen. If she clenches a victory, there’s a good chance France will leave the EU, hammering the final nail into the coffin of the European experiment. The aftermath will quickly negate the short-term positives driving European equities.

The general consensus is that Le Pen will lose. But this is only one possibility. There’s also a good chance Le Pen actually wins

. Like we said, no point in trying to predict the outcome directly. We’d rather put our money in something clear cut when it comes to these narrative “tests”. And that something is volatility.

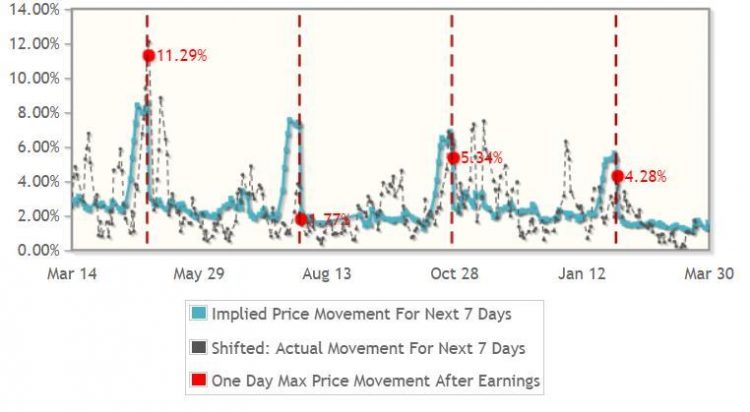

The way we play volatility heading into macro events is based off how vol behaves around equity earnings. Take a look at Amazon’s option volatility below:

The red dotted lines denote earnings announcements, and the blue line is the implied volatility of the weekly options. (To learn more about implied volatility and options click here.)

The pattern is clear. As earnings approach, traders bid up implied volatility. This reflects the increased uncertainty that comes with a data release. The results serve as a narrative “test” for the stock. After earnings are announced, implied volatility plummets as pent up uncertainty is resolved. You can see this in the chart. The blue line crashes to normal levels after each earnings date.