Copper: Fund Managers Slash Long Positions

Copper prices fell lower again this week as continued risk aversion, in response to rising geopolitical tensions, continues to weigh on commodity prices. Reflecting the shift in sentiment, the latest COT data shows that fund managers have slashed their long positions in the metal from 101k contracts at its peak to just 55k now. In terms of open interest, exposure has been reduced from nearly 35% to 19% over the same period.

Further downward pressure is being exerted as investors are growing skeptical regarding Trump’s proposed infrastructure expenditure program. The massive wave of infrastructure spending that was promised during Trump’s campaign was responsible for the explosion in metals prices over the last two months of 2016.

However, as the President has yet to announce any formal details or plans regarding the program, and is currently struggling with other areas of policy, traders are now sensing that the program will be severely delayed and the scale might be much diminished. As such, metals prices are undergoing a correction lower which, for now, seems likely to continue.

The rotation lower in copper this week took the price down to just above the next key support level at the 2.445 area which was the December 2016 low. Below there, deeper support comes in around 2.268 which was key resistance over much of 2016. T the topside, the key area to watch, remains a retest of the 2015 high along with the bearish trend line from 2011 highs.

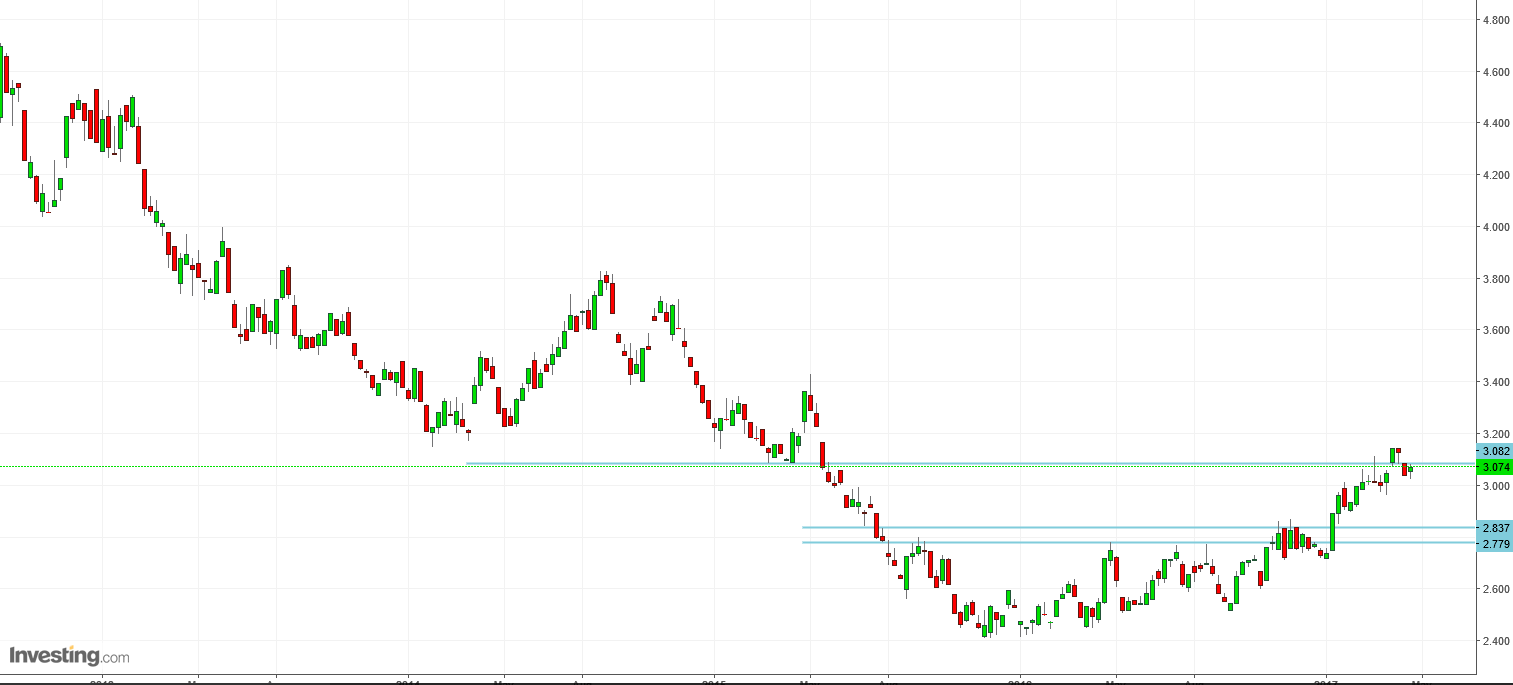

Aluminium: Price Supported By Chinese Government Production Restrictions

Aluminium prices managed to retain a firm footing this week largely fueled by developments in the Chinese aluminium sector. Over the weekend, Changji city government ordered the closure of three smelters which will remove around 2 million tonnes of aluminium from the annual supply.

Aluminium is still battling around the key 3.082 level resistance which was the mid-2015 low and a key support level. A sustained breach of this level should pave the way for a deeper correction higher, confirming the base in aluminium prices.