Stock markets used to be a reliable indicator for the global economy, and for national economies. But that was before the central banks started targeting them as part of their stimulus programmes. They have increased debt levels by around $30tn since the start of the Crisis in 2008, and much of this money has gone directly into financial markets. Today, Japan is a great example of the distortions this has produced, as the Financial Times reports:

□ The Bank of Japan (BoJ) has been buying stocks via its purchases of Exchange Traded Funds (ETFs) since 2010

□ Last July, it doubled its purchases to ¥6tn of ETFs¥6tn per year, focused on supporting Abenomics policy

□ Analysis by Japanese bank Nomura suggests its purchases have since boosted the Nikkei Index by 1400 points

Even more importantly, the BoJ is particularly active if the market looks weak. Between April 2013 – March 2017, it bought on more than half of the days when the market was down.

The distortion isn’t just limited to direct buying by the BoJ, of course. It is magnified by the fact that everyone else in the market knows that the BoJ is buying. So going short is a losing proposition. Equally, investors know that the BoJ is guarding their back – so they are guaranteed to win when they buy.

This manipulation by the BoJ is just an extreme form of the intervention carried out by all the central banks. It means that the stock market has lost its role as an indicator of the economy. And so all those models which include stock market prices in their calculations are also over-optimistic.

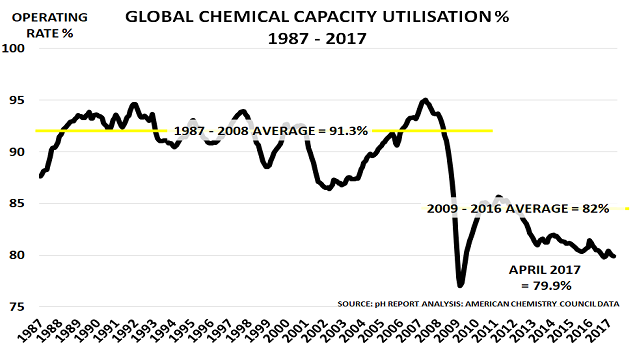

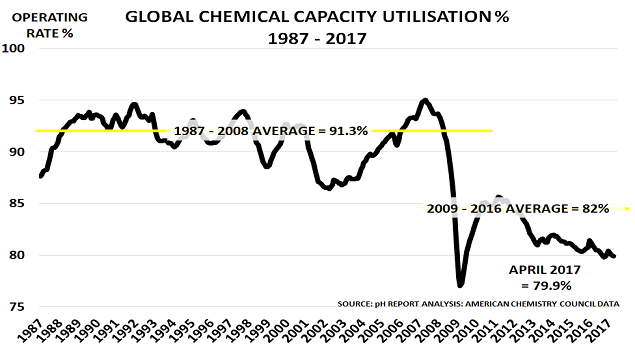

This is why the global chemical industry has become the best real-time indicator for the real economy. As I noted back in January, it has an 88% correlation with IMF data for global growth – far better than any other indicator:

“The logic behind the correlation is partly because of the industry’s size. But it also benefits from its global and application reach. Every country in the world uses relatively large volumes of chemicals, and their applications cover virtually all sectors of the economy, from plastics, energy, and agriculture to pharmaceuticals, detergents and textiles.”