We’ll get the jobs report on Friday and after Thursday’s ADP beat, there’s a palpable sense of optimism out there as evidenced by the overnight risk-on mood.

Here are the estimates:

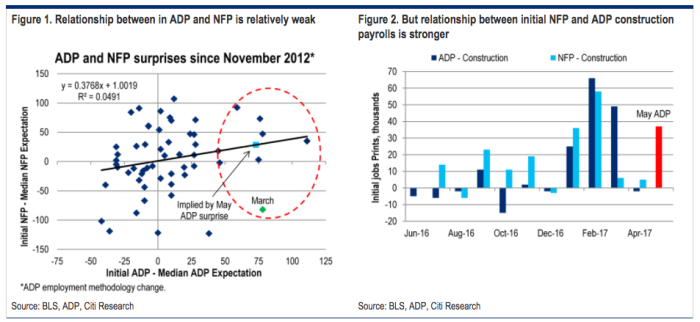

For their part, Citi sure was excited about the ADP print, upping their NFP estimate following the number:

We have revised up our nonfarm payrolls estimate to 175K in May, following the 253K job gain in the ADP report. NFP rising 175K would be down from 211K in April but in line with the six-month average gain of 176K. Average hourly earnings are likely to grow by below-consensus 0.1% MoM and remain steady on a year-over-year basis at 2.5%. The unemployment rate will probably remain unchanged at 4.4%.

That AHE bit is important. That’s why we highlighted it.

The AHE number has been on the market’s mind a lot over the last six months, and as Citi goes on to write, “soft recent inflation prints have focused market and FOMC attention on subdued price pressures [and] as a result, a downside miss on AHE as we are forecasting could reinforce the view of a lack of inflationary pressures in the economy.”

If you’ve got a short memory or if your memory is simply impaired by years of substance abuse, here’s a quick flashback to some fairly recent reports where the AHE print influenced the subsequent market reaction. Via Bloomberg:

- Report spurred gains based on 0.1% increase in average hourly earnings vs 0.3% forecast, which were erased after San Francisco Fed President Williams said there was an argument for raising rates in March

- S&P 500 rose 0.7%

- USTs fell as report included bigger-than-forecast 0.4% increase in avg hourly earnings that pushed y/y rate to 2.9%, highest since 2009, and upward revision to November NFP change to 204k; 10Y yield closed higher by 7.5bp

- S&P 500 rose 0.4%

- Report spurred temporary gains based on unexpected 0.1% drop in avg hourly earnings that pulled y/y rate down from highest since 2009; USTs resumed rising later in the session led by EGBs as focus turned to Dec. 4Italian referendum

- S&P 500 rose 0.04%

- Yields rose to session highs after jobs report, which also showed avg hourly earnings rose 2.8% y/y, highest since 2009; yields retreated and closed lower by 2bp-5bp amid steeper declines for gilt yields and drop in oil to 1-month low

- S&P 500 fell 0.2%