Over the past decades boring old insurance specialist Aflac (AFL) has done a remarkable job of enriching long-term income growth investors thanks to its impressive 34-year dividend growth streak.

That’s courtesy of its strong, cash-rich business model, which has allowed it to grow its dividend by 14.6% annually over the past quarter century, resulting in annual total returns that easily beat the S&P 500’s.

Of course past performance is no guarantee of future results, and recently Aflac has struggled to generate the kind of sales, earnings, cash flow, and dividend growth that investors have come to expect from it.

However, many insurance companies can make for great investments. Warren Buffett would agree given his ownership of GEICO and some of the insurance investments in his dividend portfolio here.

Let’s take a closer look at this dividend aristocrat to see whether or not it deserves to be a part of a diversified dividend growth portfolio.

Business Overview

Founded in 1955 in Columbus, Georgia, Aflac (American Family Life Assurance Company) is the world’s largest supplemental health and life insurance provider serving over 50 million Japanese and US customers. Its business is composed of two subsidiaries.

Aflac Japan (70% and 71% of 2016 annualized premiums and total revenue, respectively): cancer plans, general medical indemnity plans, medical/sickness riders, care plans, living benefit life plans, ordinary life insurance plans, and annuities.

Aflac US (30%, and 29% of 2016 annualized premiums, and total revenue respectively):accident, cancer, critical illness/care, hospital indemnity, fixed-benefit dental, and vision care plans; and loss-of-income products, such as life and short-term disability plans

Like most insurance companies, Aflac makes money in two ways. First, it attempts to use its long track record in these specialty industries to write profitable insurance policies that turn a profit.

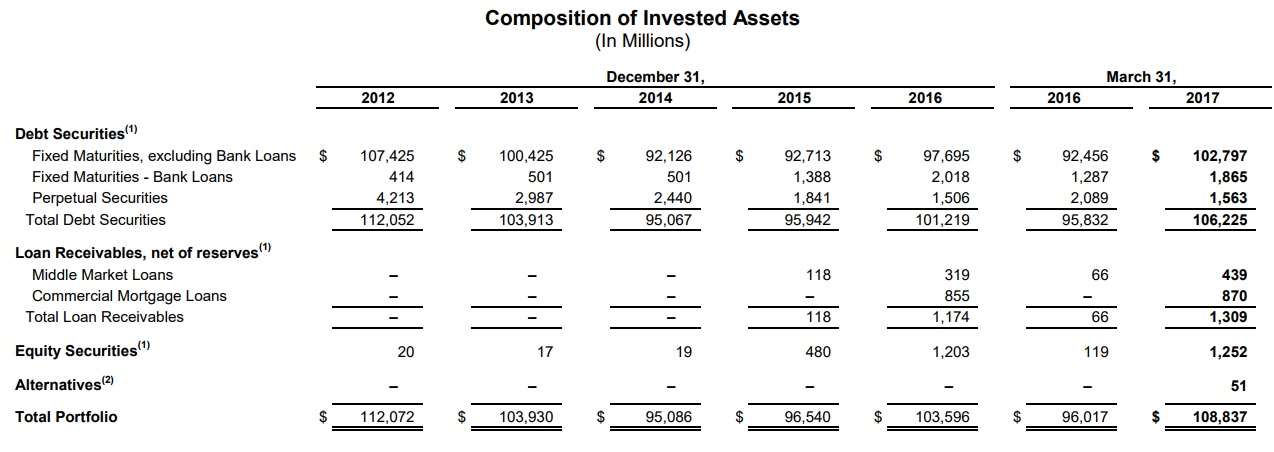

And because it receives premiums up front, while only paying out claims on a percentage of its policies over the long-term, it has access to a large amount of what’s known as insurance “float,” meaning free cash which it can invest into a low risk portfolio of assets (i.e. bonds and stocks) which further generate income and profits.

Source: Aflac 2016 10-K

Business Analysis

Aflac’s track record of strong dividend growth and market-beating total returns is thanks to its strong moat.

Aflac’s primary competitive advantages are derived from the company’s brand recognition, leading market share, distribution channels, financial strength, and conservative approach to risk management.

The company has operated in the U.S. for over 60 years and in Japan for more than 40 years, building up significant brand equity.

In fact, management estimates that about 9 out of 10 people in Japan and the US recognize Aflac’s brand. The Aflac Duck was introduced in the early 2000s and has further benefited Aflac’s recognition.

While many insurance markets are fragmented, large players like Aflac have meaningful advantages over their smaller counterparts.

Since insurance products are very similar in nature from one supplier to the next, competitors must try to differentiate on quality of service, brand recognition, and financial strength.

In addition to Aflac’s strong brand recognition and service, the company’s sheer size also plays to its advantage.

Aflac has built up a strong reputation and massive distribution networks over the course of many decades.

With such a large base of premium policies mostly being renewed each year, Aflac has the scale to keep its premiums very competitively priced (Aflac is the lowest cost provider in many cases) and offer compelling benefits to policyholders that smaller rivals cannot match.

It would take new competitors many years and cost a fortune to replicate Aflac’s distribution network, brand strength, and scale.

Beyond scale, channel networks, and brand recognition, Aflac’s actuarial expertise is another key advantage.

Specifically, its strong brand in specialized insurance products and skilled actuaries help it to avoid the kind of commoditization (i.e. low pricing power) that’s frequently the bane of many other insurance companies.

For more than a decade, Aflac’s annual cash flow from policy premiums has exceeded the policy benefits the company has paid out.

In other words, Aflac’s actuaries have done an excellent job assessing and pricing risk accordingly. This keeps Aflac’s costs very competitive and frees up more funds to be invested for additional income.