Photo Credit: Sam Valadi

JPMorgan & Chase (JPM)

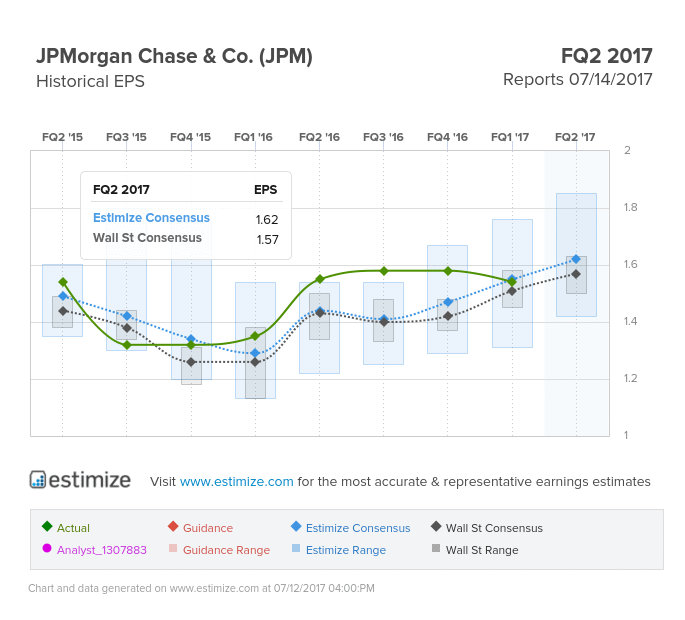

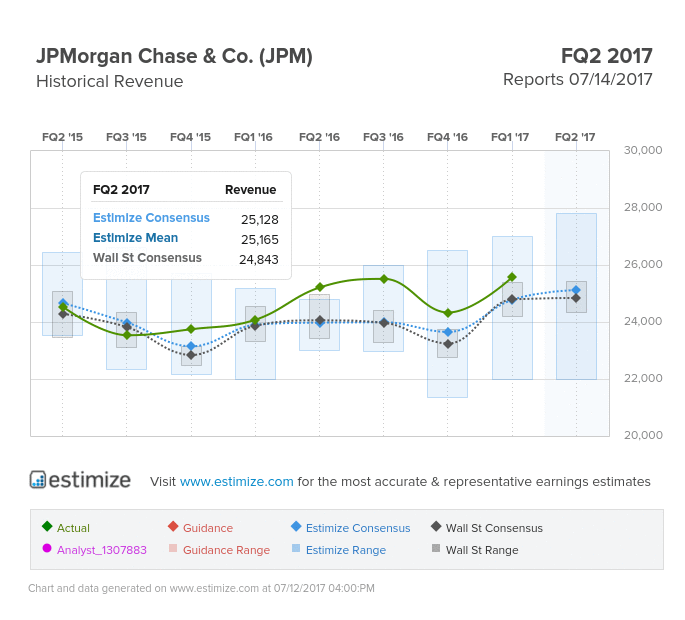

Historically, JPM has tended to outperform both Estimize and the Street on earnings, 65% and 77% of the time, respectively. This quarter, Estimize predicts EPS to be $1.63 and the Street predicts EPS at $1.60. Regarding revenue, the stock tends to outperform both Estimize and the Street 61% and 75% of the time, respectively. For FQ2’17, Estimize is predicting $25.479B and the Street comes in at $25.017B. It should be interesting to see if these trends continue this quarter.

JPMorgan has been in the media recently due to their expressed interest to acquire a British Payments Company, WorldPay. Because JPMorgan is predicted to be in a bidding war against Vantiv, a credit card processor, there has been much buzz about what will happen with WorldPay and if JPMorgan can beat out Vantiv. Likewise, recent job reports and the recent rate increase by the Fed shows a good outlook for JPM in the future. Stay tuned.

Wells Fargo (WFC)

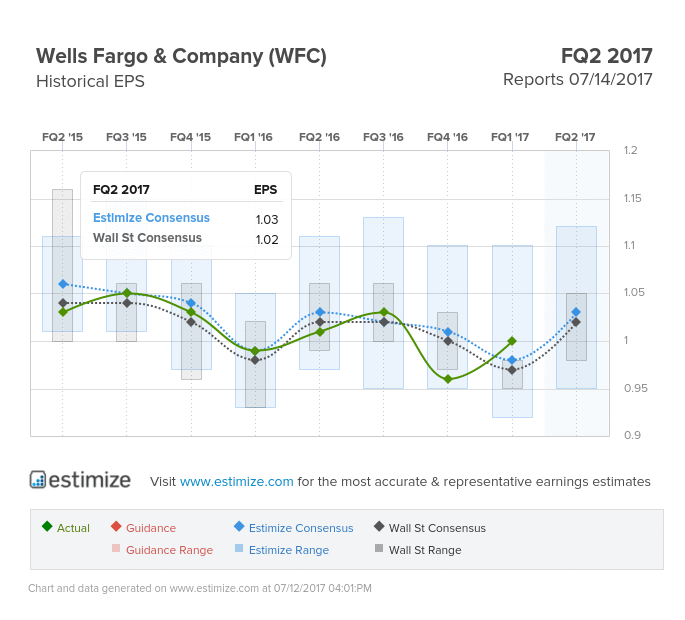

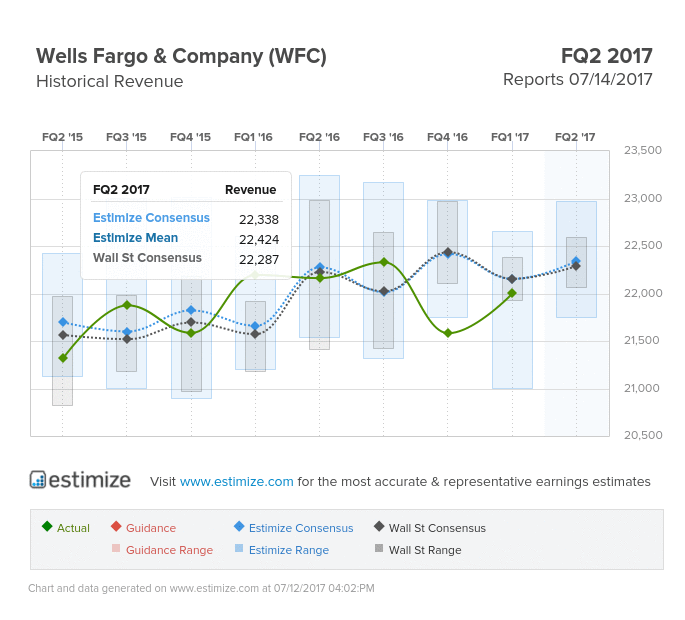

For FQ2’17, Wall Street and Estimize are coming in very close, with EPS estimates at $1.06 and $1.04, respectively. Given the fact that analysts have been pretty accurate on both ends, it should be interesting to see what happens this quarter. WFC has surpassed Wall Street and Estimize expectations a majority of the time; Wall Street 71% of the time and Estimize 52% of the time.

Wells Fargo recent stint of withholding $90 million from bondholders could potentially shake up the mortgage bond market and give investors a whole new perspective on the bank. It claims that as a trustee, it can exercise the right to hold back funds if need be. In this scenario, it claims to be doing so in order to cover legal costs. While they may have the legal right to do something like this, its effects are widespread, long-lasting and may make some investors rethink their course of action.

Citigroup Inc. © (C )

“In December, I named Citigroup the best stock to buy in 2017; now, I see no reason to move in any other direction” claimed Ken Trester, editor at Maximum Options. If we look at the Estimize data, it is easy to see why this is so. Examining EPS, it is fairly consistent with Estimize and Wall Street; Citigroup tends to outperform Estimize and Wall Street 59% and 66% of the time. This quarter, we are predicting $1.26 EPS and the Street is coming in at $1.23 EPS. Revenue is the same story, with Estimize coming in slightly higher at $17.5B vs. Wall Street’s $17.3B.