Investors looking for stable dividends should first look at blue-chip stocks.

When we use the term ‘blue chip’, we are referring to stocks with 100+ years of dividend payments to shareholders, and at least a 3% current dividend yield.

Stocks that have both of these qualities have an ideal mix of dividend history, and high yield.

We have compiled a list of stocks that satisfy these two requirements.

Phillips 66 (PSX) is on the list, and is arguably the strongest blue-chip stock in the refining industry.

Through its predecessor companies, Phillips 66 dates all the way back to 1875.

The company has raised its dividend every year since its 2012, when it was spun-off from ConocoPhillips (COP).

With four more years of dividend hikes, it will become a Dividend Achiever, a group of stocks with dividend increases for 10+ consecutive years.

And, Phillips 66 has an attractive current dividend yield of 3.3%.

This article will discuss what makes Phillips 66 a blue-chip dividend stock.

Business Overview

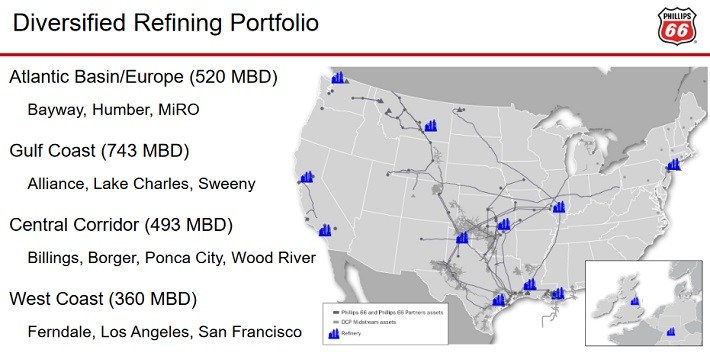

Phillips 66 is a diversified downstream company. Its core business is refining, which processes crude oil and other feedstocks into petroleum products, such as gasoline, diesel, and aviation fuel.

The company operates 13 refineries, 11 of which are located in the U.S., with a total crude oil processing capacity of 2.2 million barrels per day.

Phillips 66’s assets stretch across the U.S., and have access to some of the premier refining areas of the country.

Source: May 2017 Investor Presentation, page 14

Phillips 66 has four business segments:

As a downstream company, refining, marketing, and chemicals make up the vast majority of its earnings.

Last year was a difficult one for Phillips 66. Adjusted earnings, which exclude non-recurring items, declined by 64% in 2016, to $1.5 billion.