Today’s release of the publicly available data from ECRI puts its Weekly Leading Index (WLI) at 144.8, up from the previous week. Year-over-year the four-week moving average of the indicator is now at 4.99%, down from 5.12% last week. The WLI Growth indicator is now at 2.6, up from the previous week.

“All Signs Point to a Cyclical Slowdown in Inflation”

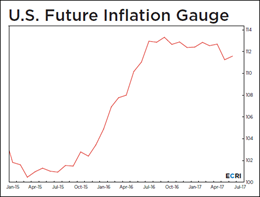

ECRI’s most recent headline article states that their U.S. Future Inflation Guage indicator is signaling a downturn in inflation. They claim that using the Phillips curve does not give a full picture of cyclical upturns and downturns. Rather than use the Phillips curve or extrapolate inflation data, ECRI says their Future Inflation Guage is a better indicator and has correctly anticipated the late 1990s growth without inflation and last year’s reflation trade. Read more

The ECRI Indicator Year-over-Year

Below is a chart of ECRI’s smoothed year-over-year percent change since 2000 of their weekly leading index. The latest level is above where it was at the start of the last recession.

RecessionAlert has launched an alternative to ECRI’s WLIg, the Weekly Leading Economic Indicator (WLEI), which uses 50 different time series from various categories, including the Corporate Bond Composite, Treasury Bond Composite, Stock Market Composite, Labor Market Composite, and Credit Market Composite. An interesting point to notice — back in 2011, ECRI made an erroneous recession call, while the WLEI did not trigger such a premature call. However, both indicators are now generally in agreement and moving in the same direction.

Appendix: A Closer Look at the ECRI Index

The first chart below shows the history of the Weekly Leading Index and highlights its current level.

For a better understanding of the relationship of the WLI level to recessions, the next chart shows the data series in terms of the percent-off the previous peak. In other words, new weekly highs register at 100%, with subsequent declines plotted accordingly.