The consumer staples industry has a compelling value proposition for conservative investors.

Why is this?

The consumer staples sector has historically been one of the best-performing sectors of the stock market…

…while also having the best recession performance.

Traditional financial theory suggests that additional risk must be assumed to generate excess returns. The outperformance of the consumer staples sector indicates that this is not necessarily true.

General Mills (GIS) is one of the most well-known consumer staples stocks. Furthermore, it is also one of the ‘bluest’ blue chip stocks around. This Blue Chip Stocks Excel Sheet contains pertinent information on all blue chip stocks with 100+ year operating histories and 3%+ dividend yields.

General Mills has a very long operating history, being founded in 1928.

Further, the company and its predecessors have paid dividends without interruption for 117 years, and its current dividend yield is 3.7%.

In fact, General Mills is a member of the Dividend Achievers, an elite group of stocks with 10+ years of consecutive dividend increases. The Dividend Achievers Excel Sheet contains useful financial information for this elite group of dividend stocks.

General Mills’ very high dividend yield, long corporate history, and strong dividend history make it stand out to long-term investors.

This article will analyze the investment prospects of General Mills in detail.

Business Overview

General Mills was founded more than 150 years ago as a single flour mill in Minnesota.

Since then, the company has grown into a global food and beverage giant, selling more than 100 brands in 100+ countries.

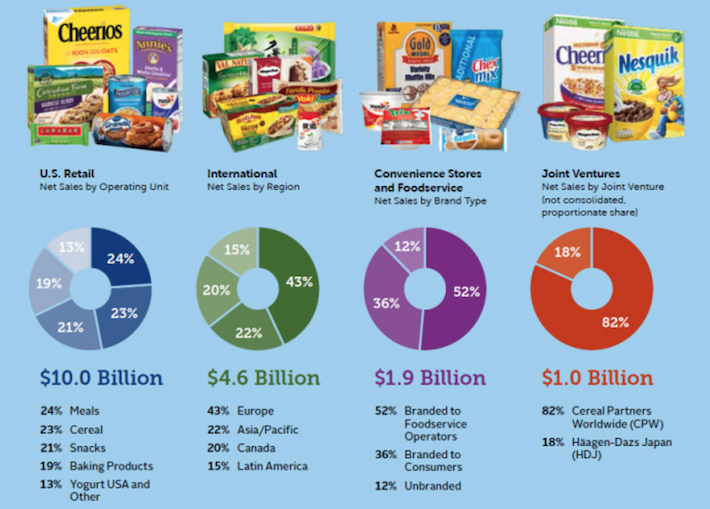

General Mills operates in four main segments:

More details about each operating segment can be seen below.

Source: General Mills Website

In the introduction to this article, I noted that the consumer staples sector has a long history of delivering outsized shareholder returns.

General Mills is no exception in this regard. The company has outperformed the S&P 500 over most meaningful long-term time periods.

Source: General Mills 2017 CAGNY Presentation, slide 6

Current Events

General Mills recently reported earnings for the fourth quarter of its fiscal 2017. Because of the structure of General Mills’ financial calendar, the company’s fiscal 2017 ended on May 28, 2017.