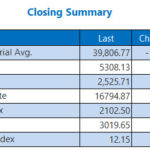

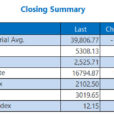

S&P futures were fractionally higher (+0.1% to 2,476) with all eyes on the Fed’s rate decision as investors await another earnings deluge from companies including Facebook, Coca-Cola and Boeing. Asian and European shares were also higher, prompted by momentum from the latest US record high; the Dollar rebound continued while oil rose above $48 as copper hit a two year high.

Risk appetite improved yesterday as oil prices kept climbing following Saudi Arabia’s commitment to export cuts. Safe-haven assets sold off, the VIX reached a new historic low, equities were up across the board, and the USD outperformed after a consumer confidence measure was higher than expected. Asian markets were mixed at midday local time. WTI advanced 0.8% to $48.26 a barrel, extending gains from the highest close in seven weeks. Crude inventories slumped by a whopping 10.2 million barrels last week according to the latest API data. Copper gained 0.6 percent in its fifth consecutive advance, hitting the highest in two years, lifting shares of producers including Glencore on expectations that demand in China will fuel a global shortage, with plans in the country to curb metal-rich waste imports reinforcing a bullish outlook.

In the overnight session, sovereign bonds opened lower in Asia following yesterday’s sharp Treasuries sell off where several selling blocks slammed futures; the Australian 10-year yield rose as much as seven basis points before easing well off the highs on an unexpected miss in headline inflation (Q2 CPI 0.2%, Exp. 0.4%) followed by a dovish speech by the RBA’s Lowe; Yield were softer at 2.32% after Senate healthcare debate gets off to a difficult start.

Stocks gained in Sydney and Tokyo, fall in Shanghai and Seoul. Japan’s Topix index rose 0.2 percent and Australia’s S&P/ASX 200 Index added 0.9 percent. South Korea’s Kospi index fell 0.2 percent, while the Hang Seng Index in Hong Kong gained 0.3 percent. The Shanghai Composite Index added 0.1 percent. The Aussie fell 0.4 percent to 79.09 U.S. cents after as noted above Australia’s Q2 headline inflation rose less than expected. 10-year Australian government notes saw yields climb four basis points to 2.73 percent. WTI crude slips below $48.50 after surging the most since November on Tuesday; Dalian iron ore futures flat.

A broad rally in commodities from oil to copper boosted European stock momentum with the Stoxx 600 index jumping 0.6%, its biggest gain in a week, as positive results from energy firms such as Subsea 7 and Tullow Oil continued to feed into markets. Energy stocks joined the broad-based global rally as oil rose above $48 a barrel for the first time since early June.The U.K.’s FTSE 100 Index increased 0.6 percent. Germany’s DAX Index increased 0.5 percent, the biggest climb in two weeks.

“The indications are more positive on the outlook for energy stocks. While there was a lot of kitchen sinking from firms in Q2 numbers, they have reset the expectations over the valuations now, they have cleaned up balance sheets,” said Angelo Meda, head of equities at Banor SIM in Milan. “The outlook is not so bad (…) We are still missing one component which is the commentary from big oil firms Total, BP, Royal Dutch Shell.”

Copper reached a two-year high on expectations of increasing demand from China. Treasuries and European government bonds rose following Tuesday’s selloff, while boosting the dollar.

While there are some nerves ahead of today’s Fed statement, Yellen is not expected to “rock the boat” in what many anticipate will be a non-event announcement. Meanwhile, earnings continue to be a source of optimism, as more than 80% of reporting S&P 500 companies beaten earnings forecasts so far this reporting period, helping to support optimism in the global economy and pushing volatility to record lows. As Bloomberg notes, “Investors are looking for guidance from the Fed on how it plans to unwind its bond portfolio, with policy makers seen keeping interest rates on hold as the U.S. central bank meeting concludes on Wednesday.”

“Top of our mind is whether there will be more clarity on efforts to unwind the US$4.5 trillion portfolio of Treasuries and mortgage-backed securities,” Isaah Mhlanga, an economist at Rand Merchant Bank in Johannesburg, said in a client note. “We think the bank will give more clarity on its intention to do so but without the specifics of timing. When the Fed eventually introduces Taper 2.0, that will be the return of volatility.”

In previewing today’s FOMC announcement, DB’s Jim Reid writes that given its late July and given the Fed will likely announce an end to balance sheet reinvestment in September (starting from October), this could be a relatively dull meeting. DB believes the Fed is unlikely to take any action in a policy firming direction at the meeting this week, partly because inflation has continued to surprise to the downside as of late. The bank expects the statement to focus on how the Fed will handle the dichotomy between a resumption of moderate growth and continuing improvement in the labour market on one hand and ongoing softness in inflation on the other. On the topic of the timing of the initial taper of balance sheet reinvestment DB writes that it will be a September announcement and October commencement remains most likely (in line with consensus), and the Committee can get by without giving any more specific guidance on timing even within this week’s statement given these relatively strongly held market expectations.

In FX, the dollar rose against most major peers ahead of the Federal Reserve’s policy decision, though options show traders are betting the euro will see more upside.The euro dropped as much as 0.3 percent to $1.1613, the lowest in nearly a week before rebounding back to 1.65 as the Bloomberg Dollar Spot Index rose for a third day. And yet, as discussed on Monday, three-month 25-delta risk-reversal for Euro options – insurance against a sharp drop in the USD – was at the highest since 2009