Regular readers know that we, much like at least one or two credit strategists we’ve spoken with at one of the major banks, believe that when it comes to Teflon assets, credit has in fact been the poster child for resilience.

Sure, vol. is low across the board, but the extent to which spreads have steadfastly refused to respond (i.e. widen notably and/or sustainably) in the face of myriad geopolitical/policy headwinds, is the picture of absurd.

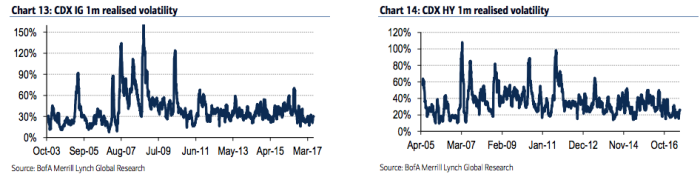

It is of course the same old story about implieds being low because realized vol. is low…

…and also because central bank liquidity is keeping things in check, but the point is that it’s patently ridiculous, especially in € and GBP credit because, well, just look at how many political land mines Europe has seen over the past 13 months.

Well, everyone has been expecting that we had a date with post-crisis tights and as Goldman writes in the latest installment of their weekly “Credit Trader” note, we’re there – or at least so close to “there” that we might as well be there. To wit:

So what should you do if you still want to get long credit?

Well, Goldman thinks you should focus on “relative value.”

What’s great about that oft-repeated recommendation is that it only sounds good when the words are arranged in just that order.

Because when you reverse the order, it doesn’t sound so great, now does it? ….

“Value is relative.”