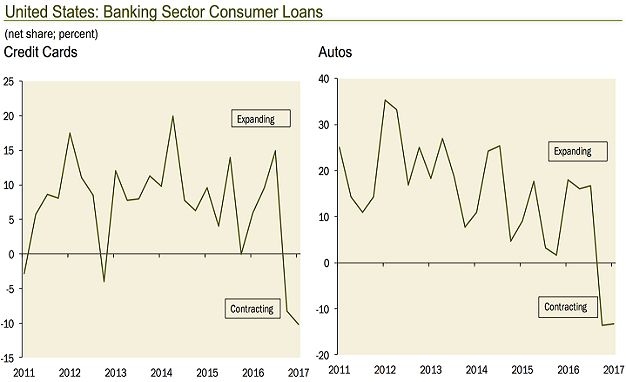

American consumers are financially strained. One indication? Card defaults rose from 2.81% back in November to 3.53% in May. Meanwhile, the expansion of credit by cards as well as by autos has slowed to the point of contraction.

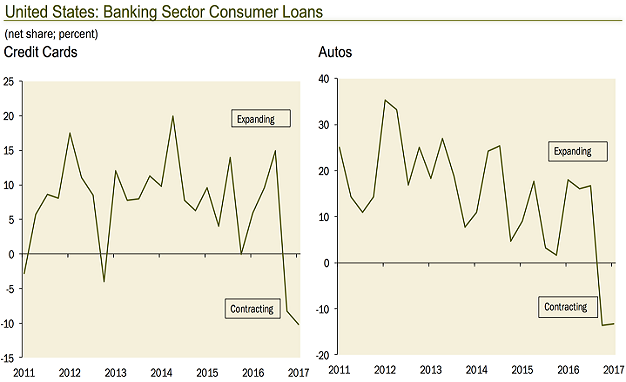

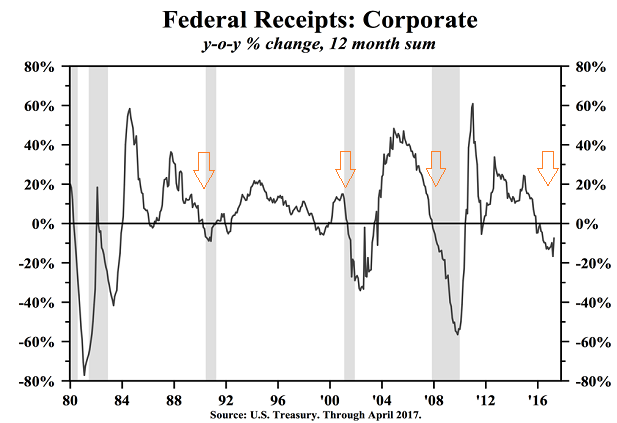

Some would have you believe that low headline unemployment (4.4%) is translating into increased consumption and increased demand for goods or services. Yet tepid GDP data demonstrate otherwise. One explanation is that nominal wage growth would need to grow in the 3.5%-4.0% range to compensate for the loss of purchasing power from inflation. However, wages have struggled to make any progress over the last 18 months.

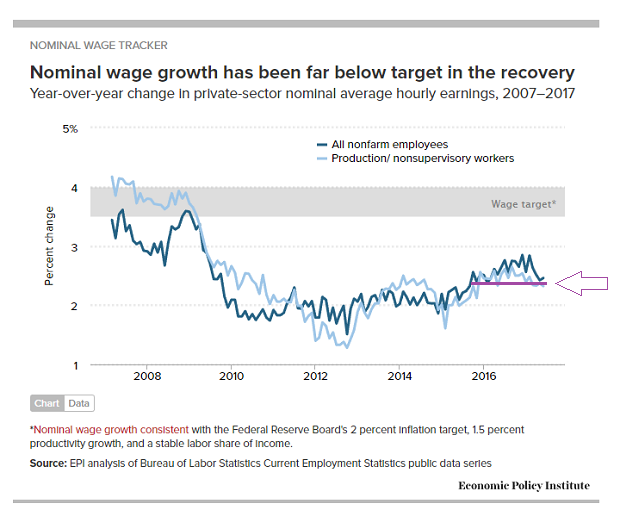

If things were any better in the corporate world, you would not know it from federal tax receipts. They are shrinking on a year-over-year basis. Keep in mind, tax receipts would be indicative of faster or slower income creation. The recent slowdown, then, points to economic fragility.

“But Gary,” you protest. “Corporate earnings growth is all that matters. That’s what investors pay for.”

Really? GAAP Earnings per share for the S&P 500 came in at $100.29 (3/31/2017). It was $100.20 on 12/31/2013. That is three years and three months without a modicum of corporate earnings improvement.

What did improve, then? The S&P 500’s price. It rose 28% over three years and three months without genuine growth in sales or profits.

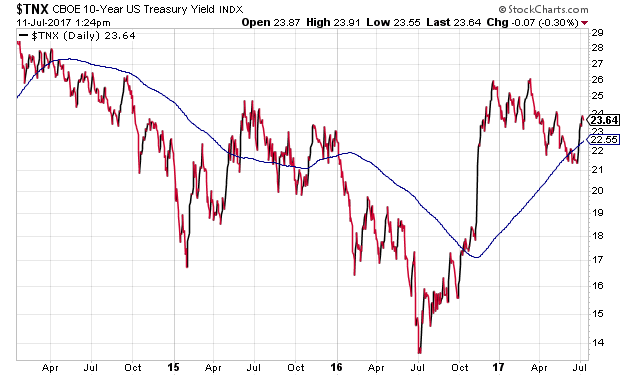

One might make a case that U.S. stocks gained significant ground over the three-plus year period because borrowing costs moved lower. This allowed corporations to borrow by the fistful and to finance stock buybacks. In spite of modest demand, prices rose because the supply of shares had become scarce.

The notion may have merit. On the flip side, borrowing costs have been rising over the last 12 months. If the lowering of absolute yields and/or a downward trajectory of key rates explained stock price appreciation in the absence of meaningful earnings per share (EPS) growth, a reversal in those trends might be expected to cause the stock bull to stagger. It hasn’t.