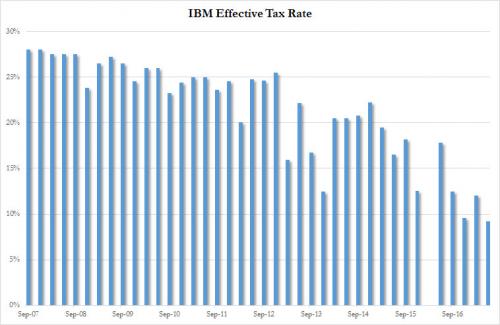

Last quarter, IBM almost fooled the market when it “beat” but only thanks to using the lowest (until then) effective non-GAAP tax rate in recent history (excluding one charge-filled quarter when the rate was negative and thus N/M).

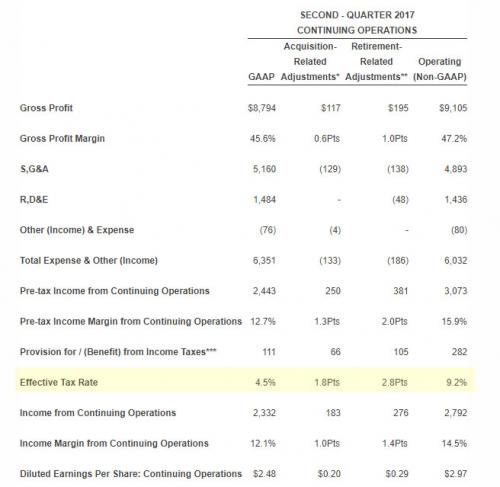

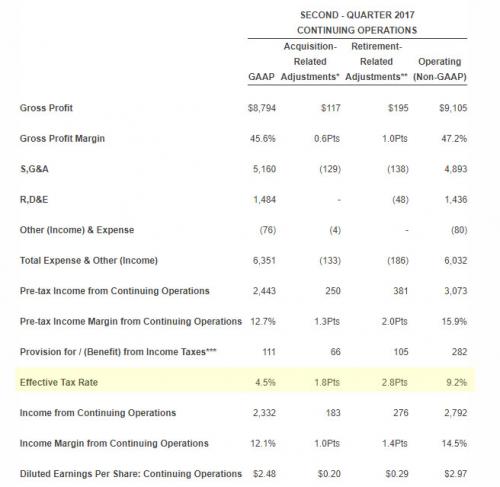

Fast forward one quarter when IBM has done it again: in the three months ended June 30, IBM reported GAAP EPS of $2.48, below the expected $2.75. Of course, when it comes to IBM it is all about non-GAAP results, which in Q1 were $2.97, “beating” estimates by 22c. How did IBM “beat” again, on a non-GAAP basis that is? By applying the lowest non-GAAP tax rate in company history, a paltry 9.2% (and just 4.5% GAAP). To wit:

IBM’s reported GAAP and operating (non-GAAP) tax rates of 4.5 percent and 9.2 percent, respectively, include the effect of discrete tax benefits in the quarter, which contributed $0.18 to the company’s earnings per share.

And visually:

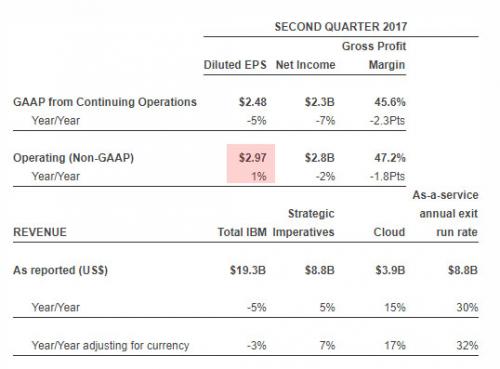

Amusingly, while both GAAP EPS and margins declined Y/Y, non-GAAP EPS was the only thing that was magically higher (with even non-GAAP net income down):

At this rate IBM will soon need a negative non-GAAP tax rate to make its negative non-GAAP earnings turn positive.

Although for some reason IBM is confident it won’t need to:

The company continues to expect a full-year ongoing effective operating (non-GAAP) tax rate of 15 percent plus or minus 3 points, excluding discrete items.

Good luck.

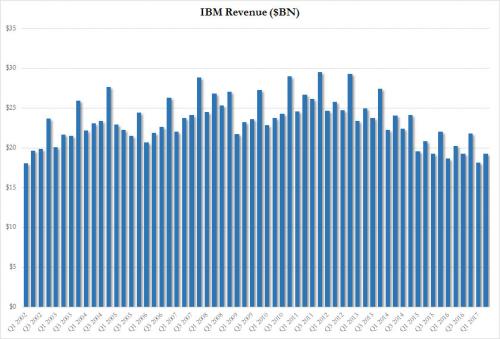

However while IBM is truly a wizard when it comes to fudging the bottom line, there was nothing it could do about the top line, and it was here that IBM’s troubles emerged, because not only did IBM once again not beat modest estimates of $19.47 billion, instead generating $19.3 billion in revenue…

… but this was also the 21st consecutive quarter of declining revenues for the company which lately can’t seem to get any traction on the top line.