Introduction

For the last five years, US stock markets have been a good place to invest. Over that period, the S&P 500 is up 77%. And in the last year, it is up 20%. But there are worrying clouds on the horizon: the price/earnings ratios are creeping up – the S&P 500 is now at 24. And nobody knows whether Trump will be able to follow through on any of his promises to spur economic growth. With the US stock markets so high and considerable economic uncertainty over what Trump will do, it is worth considering options.

In this piece, I examine a selection of Eastern European countries (EEU) targeted on the southern part of the region. FocusEconomics provides the data and I am assisted by Ken Lefkowitz, a managing partner at New Europe Corporate Advisory. Ken, an economist, has been living in Bulgaria and covering the region for more than 20 years.

Countries Worth Considering for Investments

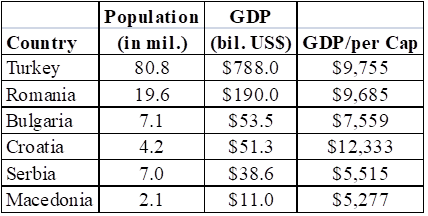

Elliott: The countries listed in Table 1 all have stock exchanges. Turkey is by far the largest while Croatia has the highest per capita income by a large margin. Should these countries be investment targets for individual or institutional investors from the West?

Ken: As you point out, size is an important criterion. Therefore Turkey and Romania merit the most attention. They are respectively the second and third largest countries after Poland in terms of population in Eastern Europe excluding the Commonwealth of Independent States (CIS). Turkey is well established as an emerging market, while Romania, long considered a frontier market, is on the cusp of achieving emerging market status – it may be worthwhile to get in early.

Croatia’s economy looks much larger than it actually is due to significant remittances. Bulgaria is worth considering due to its macro stability – more on that below. And Serbia stands out as one of the last convergence plays in the region with reasonable size and degree of industrialization. Macedonia, although extremely FDI-friendly, is too small and too unstable to prioritize. Macedonia probably looks smaller than it actually is due to a large informal economy (which also explains some of its very high trade deficit), but that is hardly investable.

Table 1. – Data on Selected Eastern European Countries, 2017

Source: FocusEconomics

Economic Strength

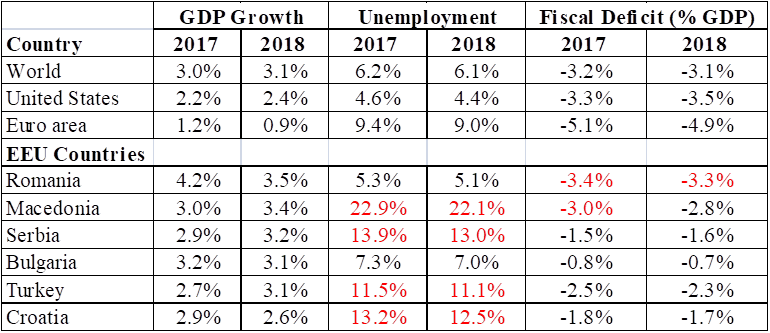

Elliott: Table 2 provides economic data on these EEU countries with the World, the US and Eurozone countries providing a frame of reference. Ranked by projected real GDP growth rates in 2018, it is notable that all EEU countries are projected to grow more rapidly than either the US or the European Union countries. I view unemployment rates greater than 10% and countries with fiscal deficits greater than 3% as worrisome.

Table 2. – Economic Indicators, EEU Countries

Source: FocusEconomics

Ken: I would counter that unemployment rates greater than 10% are an opportunity, because labor shortages are a significant issue in the better-performing countries such as Romania and Bulgaria. This is especially visible in software, information technology, and business process outsourcing, which are some of the fastest-growing industries in the region. Romania and Bulgaria will see significant wage inflation. And their tight labor markets will erode their competitiveness whereas the other countries have plenty of room to run.