If you want to trade macro, you need to understand liquidity.

PTJ, Druck, Soros, Dalio — all these legends have expressed this fact multiple times.

Liquidity is what moves markets.

This is even more true now than in the macro heydays of the 70s and 80s.

With the rise of “blind investing” in the form of passively buying and holding ETFs, the majority of investors don’t care about valuation or merit. They just auto-shuttle their excess funds to the nearest robo advisor without a second thought.

This amount of “excess funds” is largely dependent on liquidity conditions.

When liquidity is loose, it’s cheap to get levered. People have extra cash and plow it into risk assets. Prices rise.

When liquidity is tight, people have less cash to spend. They may even sell stuff to service their existing debt. Prices fall.

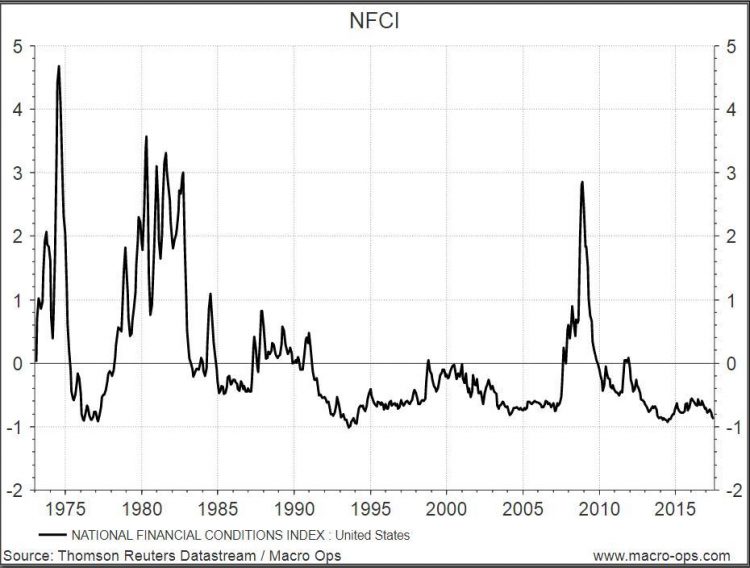

There are a myriad of ways to measure and monitor liquidity conditions. No single method is best, but one of our favorites is using the Chicago Fed’s National Financial Conditions Index (NFCI).

This index combines over 105 different indicators of financial activity to form one easy-to-read liquidity measurement. Money markets, debt markets, equity markets, traditional banking systems, “shadow” banking systems — they’re all included.

The zero line represents average liquidity conditions. Positive values indicate tighter-than-average conditions and negative values indicate looser-than-average conditions.

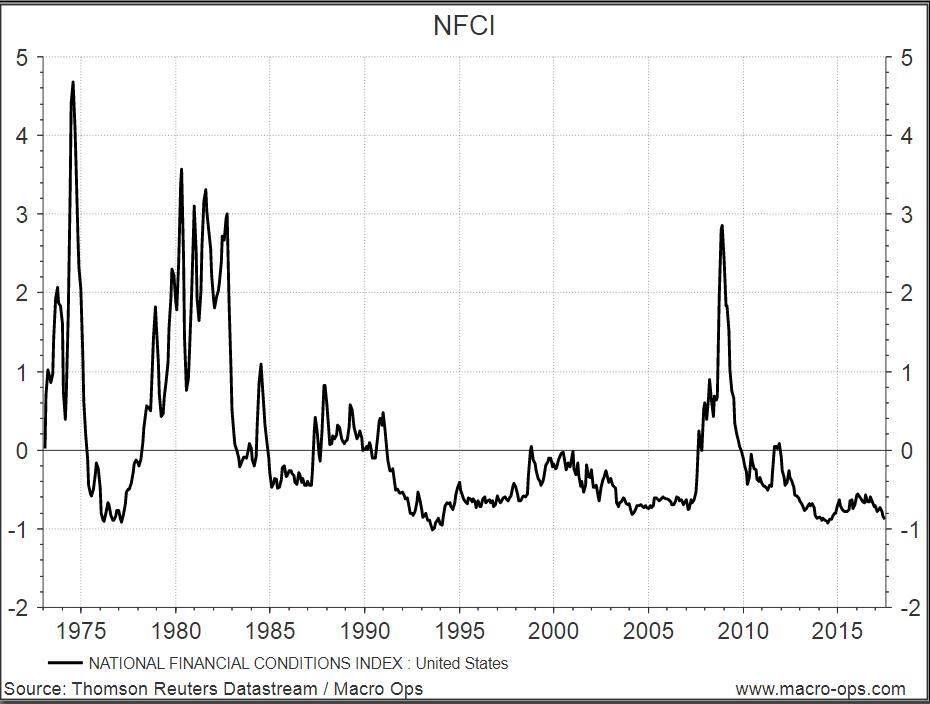

The Chicago Fed also publishes the Adjusted National Financial Conditions Index (ANFCI).

Since financial liquidity conditions are highly correlated to economic conditions, this index isolates the uncorrelated component. It tells us what liquidity conditions are like relative to economic conditions.

Positive values indicate liquidity conditions are tighter than would be suggested by current economic conditions, while negative values indicate the opposite.