For the second part of my “Canadian Telecoms on the radar”, I’m taking a look at Rogers Communications (RCI). The company rid the market this year with +27% as at July 22nd 2017. Is it too much? Is it too late to pick this gem? Let’s dig deeper to find out!

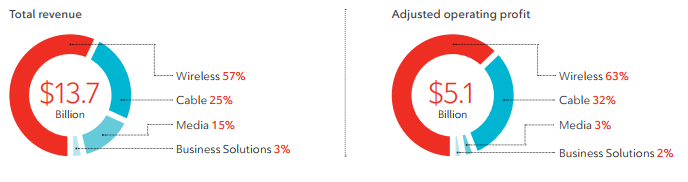

Rogers Communications has adapted since its creation to offer the services and technology its clients were looking for. It started with radio broadcasting, added television and internet services, and now has a predominant wireless business segment:

Source: RCI 2016 annual report

Revenue

Revenue Graph from Ycharts

Rogers has shown a very strong revenue progression since 2008. The company’s latest move was pricey, but I appreciate the effort to always bring something new to the table for shareholders. Back in 2013, RCI agreed to pay $5.2 billion to own the broadcasting right of all the NHL games. It now appears as very good timing as the Oilers & Maple Leafs are now back in the race for the cup with young and talented teams. Sports now represent more than 50% of RCI’s media segment revenue. Rogers also tends to pay high prices for new spectrum licences, a must in the wireless industry.

How RCI fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

Source: Ycharts

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rules: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly comes with dividend growth and this is what I am seeking most.

Source: data from Ycharts.