The Dividend Aristocrats are some of the highest quality businesses around.

With 25+ years of consecutive dividend increases, these companies have proven both their ability and willingness to return cash to shareholders.

The long dividend histories of the Dividend Aristocrats is indicative of strong, enduring competitive advantages.

With that said, not every Dividend Aristocrat makes a compelling investment at any given time. Some will be overvalued while others are undervalued.

Right now, Aflac (AFL) is the Dividend Aristocrat with the cheapest valuation based on a weighted index of price-to-earnings, price-to-book, and price-to-cash-flow ratios.

The company may be a compelling buy at today’s prices.

This article will analyze the investment prospects of Aflac to determine whether this cheap Dividend Aristocrat is a screaming buy or a value trap.

Business Overview

Aflac Incorporated is the world’s largest provider of supplemental insurance.

The company is also engaged in the underwriting of other types of insurance, including health, Medicare supplement, life, accident, and long-term convalescent care insurance.

Aflac was founded in 1955, has increased its dividend for 33 consecutive years, and has a current market capitalization of $30.8 billion.

To understand Aflac’s business model, it is very important to understand what supplemental insurance really is.

Supplemental insurance offers protection to policyholders from certain qualifying events, including cancer diagnosis, disabilities that keep the insured from working, or other particular medical events.

Once a qualifying event has been declared by the policyholder, Aflac pays cash benefits directly to the insured. These cash benefits are fixed and do not increase with inflation over time.

Aflac provides supplemental insurance in two distinct geographies:

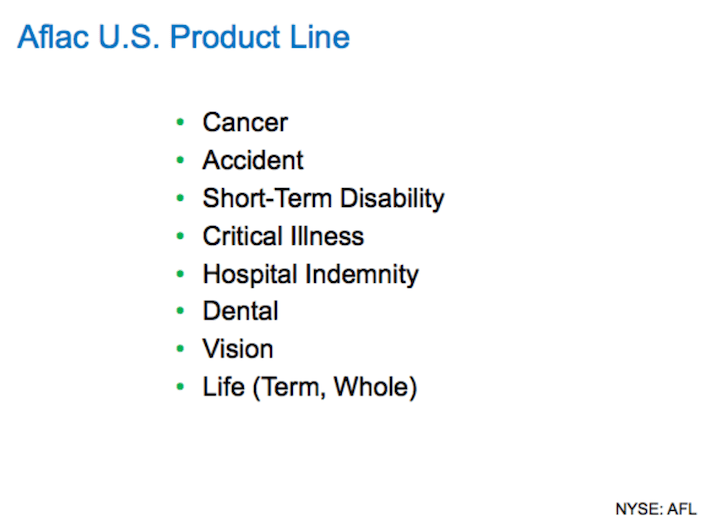

The company’ product offering differs slightly between its two operating geographies (although both specialize in supplemental insurance).

Aflac U.S. also offers cancer, accident, and short-term disability, along with dental, vision, and various forms of life insurance.

Source: Aflac June 2017 Investor Presentation

In addition to supplemental insurance, Aflac Japan also offers life insurance products and two forms of savings plans.

Source: Aflac June 2017 Investor Presentation

Because of Aflac’s significant presence in Japan, the company is heavily exposed to the Yen/Dollar exchange rate.