Copper: Red Metal Rocketing on Strong China Story

Copper prices exploded to their highest level in over two years this week thanks to US Dollar weakness and a China-related story which has been fuelling commodity markets. The US Dollar continued its decline this week as the Fed kept policy unchanged at the July FOMC. The Fed said that they intend to begin balance sheet normalization soon (which markets expect will be in September) but the key focus was the downgrading of the bank’s inflation assessment.

Following four consecutive misses on the CPI reading, the Fed noted that measures of inflation have declined and that CPI is running below the bank’s 2% target but is expected to hit the target over the medium term. Subdued inflation is leading to many to reprice the odds of a rate hike over the remainder of the year which now sits at just 46% for the December meeting.

Alongside Dollar weakness, the reporting of a potential ban on scrap metal in China sent copper surging higher as traders capitalised on the expected increase in demand for refined metals. It was reported on Wednesday that the recycling branch of the country’s non-ferrous metals Association received a notice from government officials that there will be a ban on importing scrap copper by the end of 2018.

According to SMM, data shows that the country imported around 1.2mio tonnes of copper last year and is expected to import around 1.27mio tonnes this year, of which around 750k – 950k tonnes would fall under the new ruling. As such, there would need to be a significant increase in the purchase of refined metals to make up the shortfall.

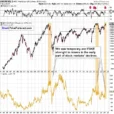

Having spent the year so far congested in a tight range, copper bulls were finally rewarded this week as the red metal exploded higher, continuing the momentum that built up over the Trump election campaign. Copper has now broken above the long term bearish trend line from 2010 highs and is fast approaching the 2015 swing high around 2.956. If the weekly close remains above the bearish trend line, traders can expect a test of 2015 high next. To the downside, support comes in at the rising channel base running from late last year.