Yesterday, the greenback extended losses against the Canadian dollar, which resulted in a drop below the May 2016 low. Does it mean that the way to lower levels is open?

In our opinion the following forex trading positions are justified – summary:

EUR/USD

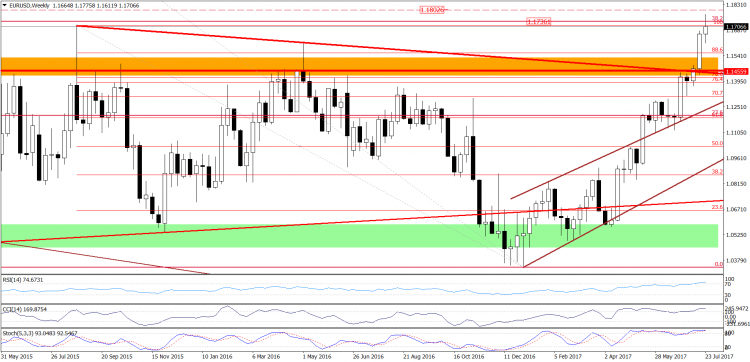

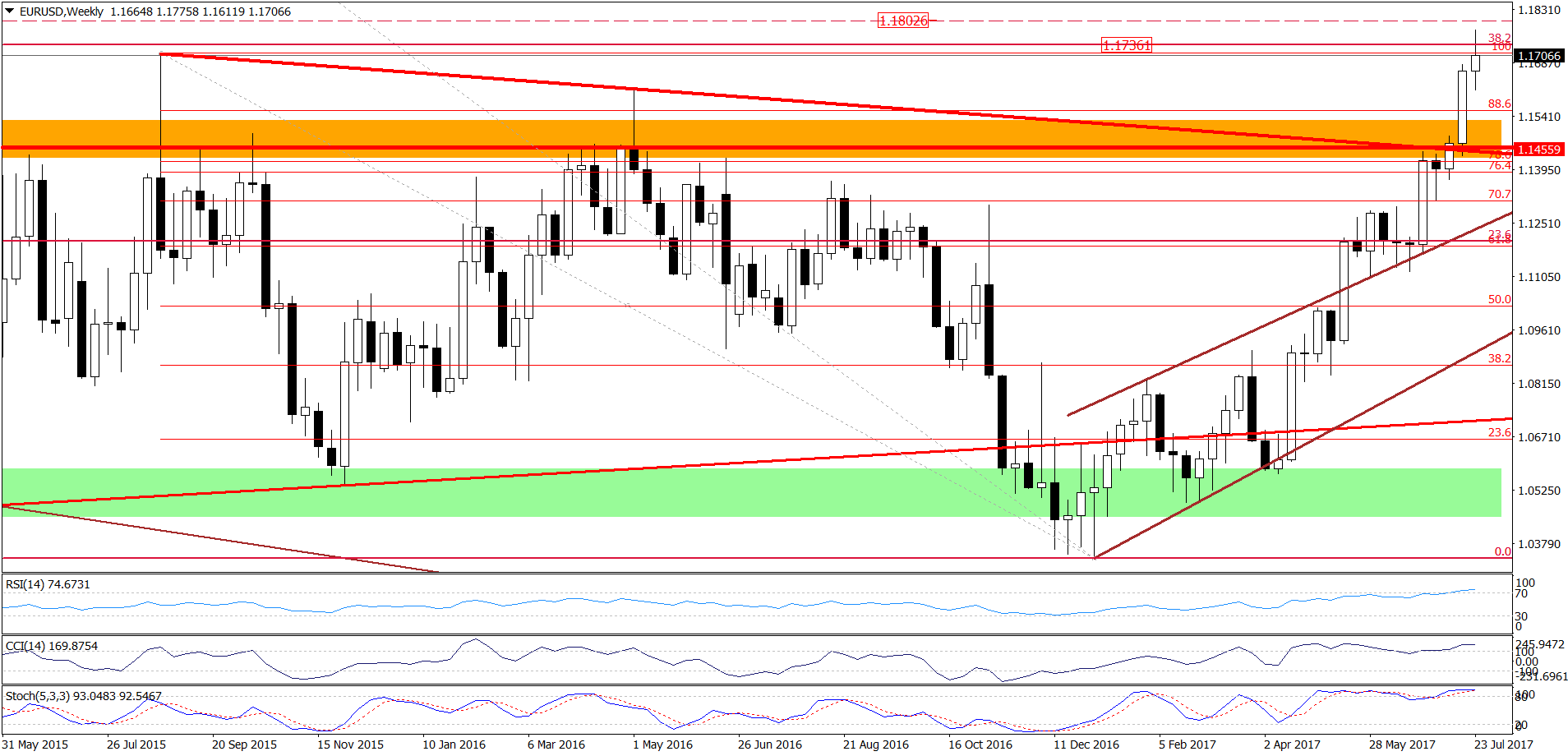

Yesterday, EUR/USD came back above the upper border of the green consolidation and the upper border of the brown rising trend channel, invalidating the earlier breakdown under these lines. Thanks to this move the exchange rate also climbed above the August 2015 peak and the 38.2% Fibonacci retracement (both seen on the weekly chart). Despite this improvement, currency bulls didn’t manage to hold these levels, which encouraged their opponents to act earlier today. As a result, the pair pulled back and slipped under the August 2015 peak and the 38.2% Fibonacci retracement, invalidating the earlier breakout. Although this is a negative development, it will turn into bearish if EUR/USD closes this week under these two major resistance levels. If additionally, the exchange rate invalidates the breakout above the upper border of the green consolidation and the upper border of the brown rising trend channel currency bears will receive important reasons to act. In this case, we’ll likely see an acceleration of declines and EUR/USD will drop to its first downside target around 1.1408, where the lower border of the brown rising trend channel currently is. If this support is broken, the way to lower levels will be open.

Very short-term outlook: mixed with bearish bias

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

USD/JPY

On Friday, we wrote the following:

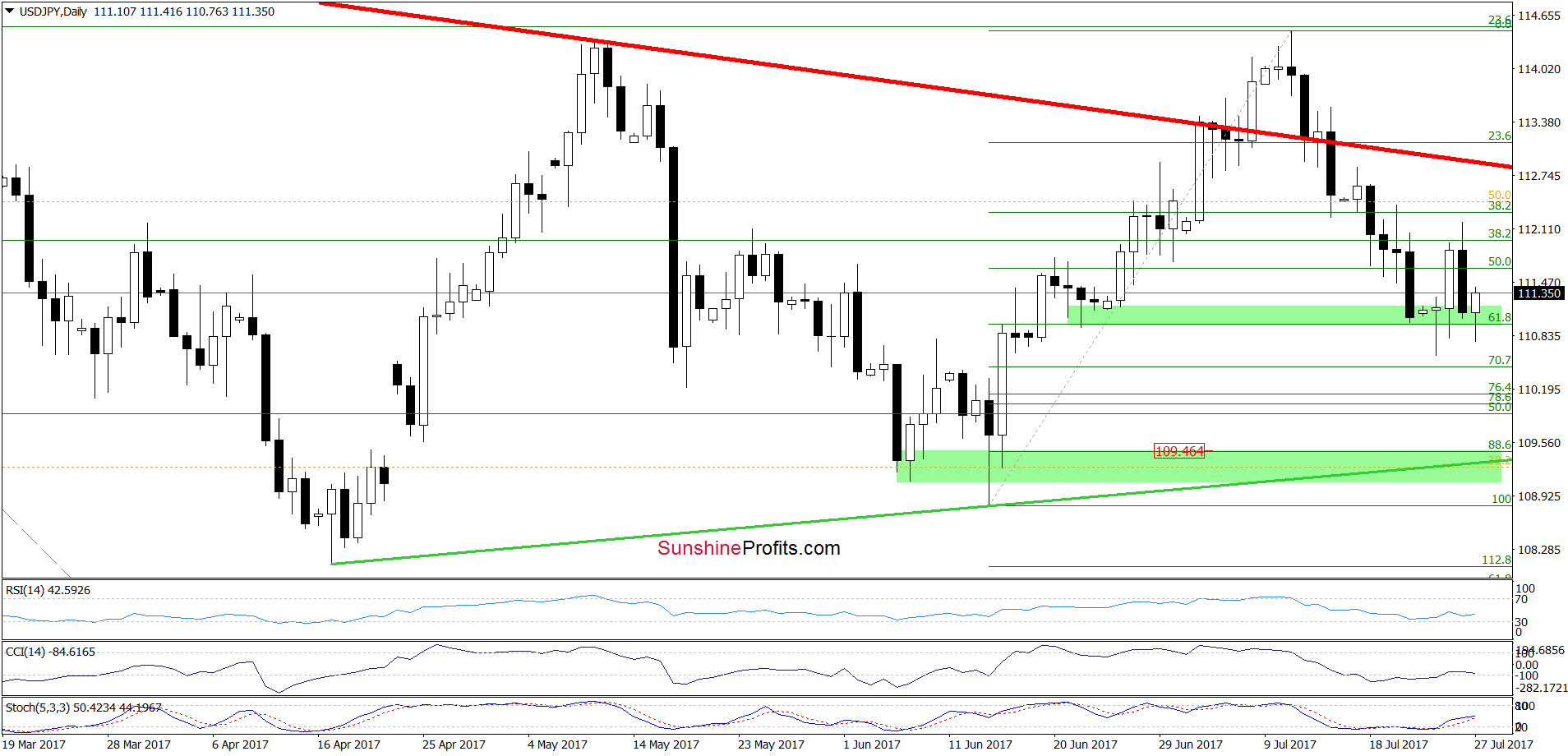

(…) the breakdown under the red declining support line encouraged currency bears to act. As you see on the daily chart, a decline below the 38.2% Fibonacci retracement triggered further deterioration and a drop below the next retracement. What’s next? Taking into account an invalidation of the breakout above the red line and a drop below the 50% retracement, we think that the pair will extend losses and test the nearest green support zone in the coming day(s).