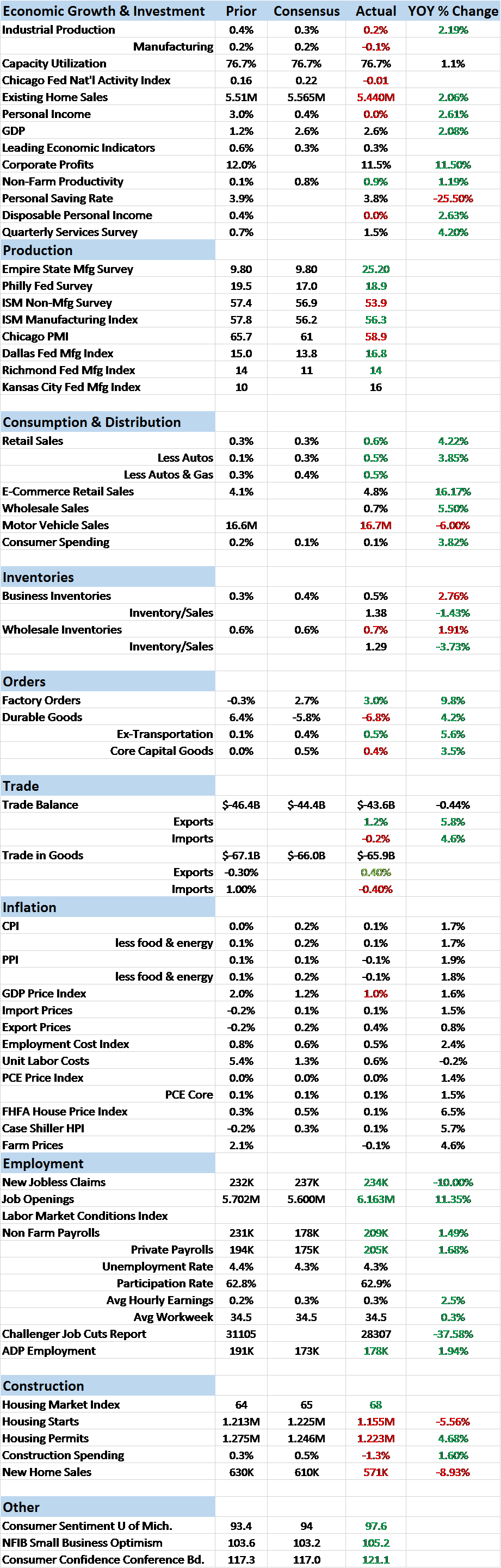

The economic reports released since the last update were slightly more upbeat than the previous period. The economic surprises have largely been on the positive side but there were some major disappointments as well. The economy has been doing this for several years now, one part of the economy waxing while another wanes and the overall trajectory not much changed. Indeed, the broad Chicago Fed National Activity index probably says it all, coming in at -0.01. That number represents current growth versus the longer term trend with positive being better than trend growth and negative being worse than trend growth. -0.01 is about as close to on trend as you’re going to get. And that trend is the now very familiar, frustratingly new normal, secular stagnating rate of about 2%.

As I said though, there were some better than expected reports and we should note them. Who knows; it could be the start of a trend. Durable Goods orders, once you get past the headline -6.8% which was driven by Boeing orders, were up nicely year over year and the market took them as pretty positive. Even core capital goods orders were up 3.5% year over year. But don’t get too excited. As Jeff points out, the level of orders and shipments is still well below the peak of 10 years ago. Lost decade anyone? So, yes things have improved in the short term but we’re a long way from healthy.

Further complicating the durable goods report was an Industrial Production report that was at least a little contradictory. IP was less than expected and the manufacturing part was outright negative. The auto industry was the culprit with motor vehicle assemblies down a rather scary 14.5% from last year, the worst since 2009. Sales are already well off their highs and inventories are too high so ramping up production right now seems unlikely. Yes, these numbers are volatile and often see substantial revisions but the trend in autos was down before this release.