I’m playing both sides of the market right now, as it is becoming near impossible to put full faith in the case of the bulls or the bears.

Indicators

VIX – Close to going back into the 10’s yet again as VIX lost 14% yesterday. Now down over 27% since Thursday’s close.

T2108 (% of stocks trading below their 40-day moving average) – Strong move yesterday of 13.8% but very little improvement overall on the chart.

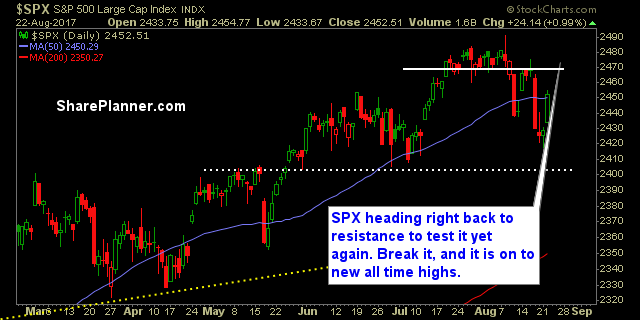

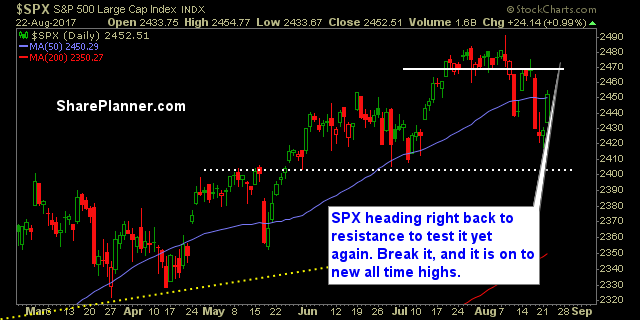

Moving averages (SPX): MA’s are losing their luster as price continues to rip above and below them with little reaction. $SPX broke back above the 5, 10 and 50-day moving averages yesterday with no resistance.

Industries to Watch Today

Defense coming back around nicely and definitely deserves some consideration. Semis could finally come around if the market can rally back from the pre-market losses. Financials bounced yesterday, but still a rough chart for trading. No life in Energy. Utilities are unstoppable still.

My Market Sentiment

Yesterday showed the signs of a hard market bounce, now we have to wait and see whether the bulls can run with it here, or whether they will succumb to downside yest again.

Large caps > Small caps.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance:

Recent Stock Trade Notables: