Every so often an article is produced that is so misleading that it must be addressed. The latest is from Sol Palha via the Huffington Post entitled: “Buffett Indicator Is Predicting A Stock Market Crash: Pure Nonsense.” Sol jumps right in with both feet stating:

“Insanity equates to doing the same thing over and over again and hoping for a new outcome. These predictions have been off the mark for almost 10 years. One would think that would be enough for the experts to re-examine the situation, but instead, they use the same lines they used 10 years ago. One day they will get it right, as even a broken clock is correct twice a day.”

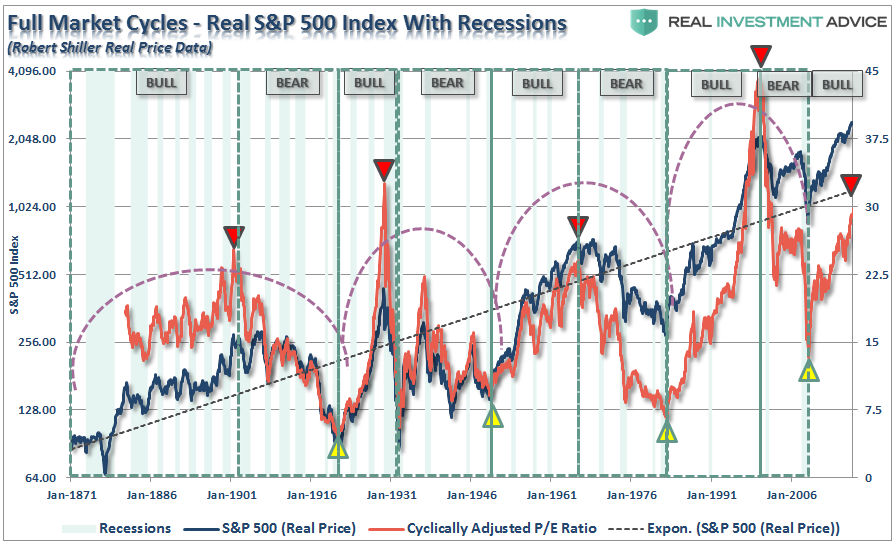

Sol should be careful of throwing stones at glass houses. While we are indeed currently in a very bullish trend of the market, there are two halves of every market cycle.

“In the end, it does not matter IF you are ‘bullish’ or ‘bearish.’ The reality is that both ‘bulls’ and ‘bears’ are owned by the ‘broken clock’ syndrome during the full-market cycle. However, what is grossly important in achieving long-term investment success is not necessarily being ‘right’ during the first half of the cycle, but by not being ‘wrong’ during the second half.”

With valuations currently pushing the third highest level in history, it is only a function of time before the second-half of the full-market cycle ensues.

That is not a prediction of a crash.

It is just a fact.

The Buffett Indicator

It is also the issue of valuation that leads Sol astray in his article which focuses on one of Warren Buffett’s favorite measures of valuation: Market Capitalization to Gross Domestic Product.

Sol errs in the following statement:

“Some Experts point out that Warren Buffet is betting on a Stock Market Crash. This claim is based on the fact that Buffett is sitting on $86 billion in cash. They use this information to create the illusion that this Buffett Indicator is predicting a stock market crash.”

First, valuations DO NOT predict market crashes.