Orthodox monetary theory tells us that central banks matter, a lot. Monetary policy is supposed to be the difference in everything from economy to currency. If one central is doing one thing and another central bank something different, it is presumed the only necessary information to infer what markets and therefore economies might do in response. The Federal Reserve is “tightening” while the Bank of Japan remains on QQE (with YCC and clowncar rack and pinion steering). Therefore the US dollar is rising against the yen, right?

That’s obviously a loaded question where we know the answer to be the opposite. It’s not the only case where these sorts of orthodox assumptions have been clearly violated and in important ways for vitally important reasons.

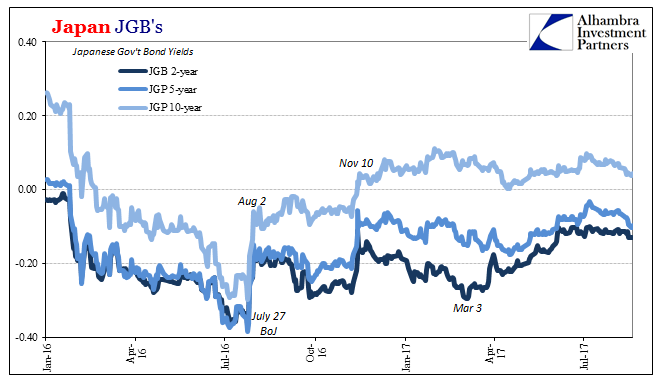

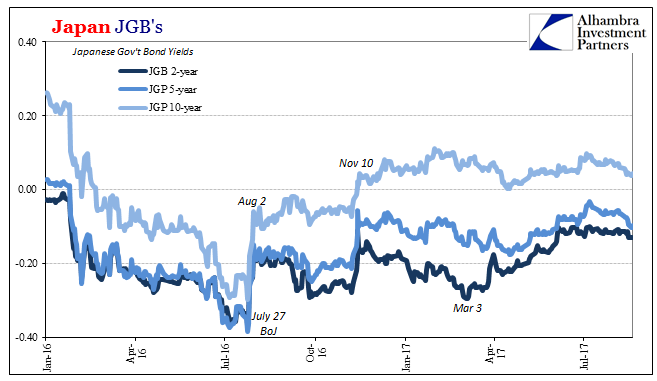

Japanese government bond (JGB) yields have been rising at the short end. They aren’t really yields of course, but negative interest rates for Japanese banking institutions overpaying the privilege of holding liquid alternates to NIRP-attested reserves. The rise in the JGB 2s, for example, is like that of the German 2s where starting around March there was some less enthusiasm for paying each government as an “investment.”

Yet, that improvement so far as liquidity preferences has gone has not translated into higher nominal yields down the JGB curve. That’s surely the BoJ, right? After all, YCC, or yield curve control, was aimed at the 10s to make sure that yields there stayed predictable – and they have, for the most part.

The point of the exercise, however, was to steepen the JGB curve so as to signal if artificially to the global bond market that things really were improving in Japan in tandem with economic improvement elsewhere; the ubiquitous yet intangible and never definable rising “global growth.” In other words, it was expected that negative 2s and shorter would remain or even lessen further like European markets, thus keeping the 10s near and around 0.00% would mean a steeper curve.