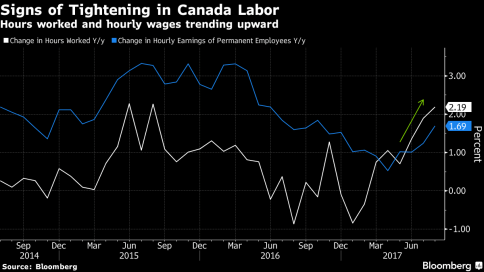

Headlines today cheer that Canada added 22.2k jobs in August and the jobless rate declined to 6.2%, the lowest since 2008. See: Canada Wages Speed up as jobs gains for ninth month.

The Canadian dollar jumped 2% against the greenback this week on continued divergence in monetary policy between the Bank of Canada daring to hike rates .25 and the fearful US Fed pausing some more.

The reality is that self-employed workers made up the full increase in Canadian total employment in August, while the number of employees fell by more than 10,000, on declines in goods-producing industries. The stronger loonie is hurting, not helping here.

Although this chart shows Canadian wages gaining 1.8% in August, average earnings have been negative since oil prices relapsed again in 2015, and are still well below the average hourly wage gains of 2.6% since 1998. Context is critical.

This next chart shows the bigger picture trend in Canadian wage growth since 1998 up to March and before the latest bounce. Clearly wage gains have not been the reason for peak consumer spending and record real estate gains the past few years.

The truth is that incomes have not kept up with increasing spending for at least 3 decades and the gap was filled for years with debt. The ratio of those accumulated payments to income is now so high that spending will be constrained for years to come, even if rates can stay flat indefinitely.

For similar evidence in America see Consumer credit and The American conundrum and the below chart courtesy of Lance Roberts showing that different than in the 80’s–where consumers first drew on stored savings to boast their spending power, and then began increasing credit to do so– since 2oo9, they have been adding credit not to increase consumption but rather just to pay for their living expenses. We should not be surprised then, that credit delinquencies are rising and the retail sector is in retreat.