Here are the historical tendencies for forex pairs and commodities in the month of September. Statistics include how often the prices rise or fall and by how much on average.

Also check out: These Stocks Tend to Perform Well in September, if interested in stocks.

Statistics are based on monthly opening and closings prices, and do no reflect overall volatility that occurs during the month. Commodity statistics are based on a continuous futures contract, which may differ from specific contract statistics.

Statistics are run on USD Index, AUDUSD, USDCAD, USDCHF, EURUSD, GBPUSD, USDJPY, USDMXN, NZDUSD for currencies and on light crude, natural gas, corn, gold, silver, copper, coffee, sugar and wheat for commodities.

Only the commodities and currencies on this list that tend to rise/fall in September more than 65% of the time (over the last 20 years) are discussed below. Other assets that are noteworthy but that don’t meet that 65% threshold may also be discussed. Applicable ETFs are also mentioned.

Seasonality statistics are best utilized in conjunction with strategies that provide exact entry, exit and risk management protocols. For examples of such strategies, see the Forex Strategies Guide For Day and Swing Traders.

Forex Seasonality For September

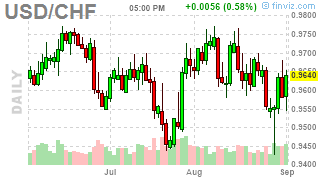

USDCHF: The USDCHF has fallen in 14 out of the last 20 years (70%). The average loss is -0.6%.

This would indicate the USDCHF forex pair could be under downward pressure in September.

The Swiss Franc ETF (FXF) has risen in 6 of the last 11 years (55%), but has dropped by -0.4% on average. While the rally percentage still indicates USD weakness and CHF strength (FXF moves like CHFUSD, not USDCHF), we can see that some of the losses have been bigger than the gains in recent years resulting in the average loss on long positions.

Commodity Futures Seasonality For September

Gold (GC) tends to be strong in September. It rallied 14 out of the last 20 years (70%) and has moved up by 2.5% on average. Shorter-term it hasn’t fared quite as well, as the ETF shows…