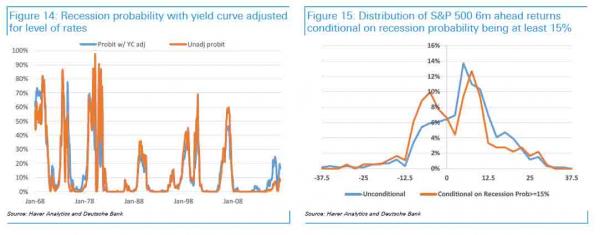

Yesterday, when commenting on the impact of Hurricanes Harvey and Irma, we noted that even before the two devastating storms were set to punish Texas, Florida and the broader economy, erasing at least 0.4% GDP from Q3 GDP according to BofA and costing hundreds of billions in damages (contrary to the best broken window fallacy, the lost invested capital more than offsets the “flow” benefits from new spending, which is why the US does not bomb itself every time there is a recession to “stimulate growth”), things were turning south for the US economy, which in turn prompted Deutsche Bank to point out that (adjusted) recession risk, at roughly 20%, is now the highest in the past decade, and that it was quite prudent for the Fed, which expects to hike rates at least once more in 2017, to according to BofA, especially since a period of both economic and market weakness is imminent.

It didn’t take long for one of the most bullish on the US economy banks to follow in BofA’s footsteps, and overnight in a note from Goldman’s chief economist, Jan Hatzius, announced the he was slashing his Q3 GDP estimate by a whopping 30%, or 0.8%, to 2.0% annualized, to wit:

the potentially sizeable growth effects from Harvey—and with Irma risks now moving to center stage—we lowered our Q3 GDP tracking estimate by 0.8pp to +2.0%…

But fear not, because like all good Keynesian acolytes of the “broken window fallacy”, Goldman is confident that the flawed perpetual engine of growth, namely destruction – after all, why else is the world’s gearing for global war – will kick in, and more than offset the Q3 GDP loss, by boosting the next 3 quarters by a cumulative 1.1%:

… However, we expect this weakness to reverse over the subsequent three quarters, more than recouping the lost output. Accordingly, we are also increasing our respective quarterly growth forecasts by 0.4pp, 0.2pp and 0.4pp for Q4, Q1, and Q2, (to +2.7%, +2.5%, and +2.4%). We will revisit these estimates once reliable information about the toll from Irma becomes available. We stress that the overall impact of the hurricane on second-half growth is uncertain, as the negative effects are likely to be offset by an increase in business investment and construction activity once the storms have passed.

Some additional detail on what Goldman expects will happen in the coming months to the US economy:

We find that major natural disasters are associated with a temporary slowdown in most major growth indicators. We also find that costly and broad-based natural disasters are associated with particularly large declines in economic activity, but also sharper subsequent rebounds. Modeling these effects, we estimate that hurricane-related disruptions could reduce 3Q GDP growth by as much as 1 percentage point. We believe the main channels for these GDP effects are consumption, inventories, housing, and the energy sector.

We expect a meaningful drag on key growth indicators over the next two months (detailed herein), including a temporary drag on September payrolls growth of 20k—or as much as 100k if severe storm effects persist into next week (the payrolls reference period).We also expect a near-term boost to headline inflation (around 0.2pp on the yoy rate) due to higher gasoline prices, and a possible modest boost to core inflation (worth less than 0.05pp), due to the destruction of some of the automotive capital stock.