As noted in our week ahead preview, the Riksbank faced a rather daunting task headed into today’s rate decision.

Obviously, they have to exercise caution. They’re effectively beholden to whatever the ECB does. As Governor Stefan Ingves told Bloomberg earlier this year, “when you are next to an elephant, you have to be careful.” Simply put: they need to remain as noncommittal as possible until Draghi tips his hand or risk unwanted krona strength that could derail inflation. Meanwhile, they have to keep an eye on the housing bubble.

“The Swedish krona is the strongest G-10 performer in 2017, and policy makers will not want to add fuel to this by taking a hawkish stance at today’s rate announcement,” Bloomberg’s Richard Jones wrote this morning.

“The Riksbank has been fighting krona strength for several years now and if they were to even hint at tightening, the krona would take off,” Nordea’s Torbjorn Isaksson noted earlier, underscoring that point.

Well, they kept rates unchanged at minus 0.50% Thursday and they’re shamelessly clinging to the inflation excuse. To wit:

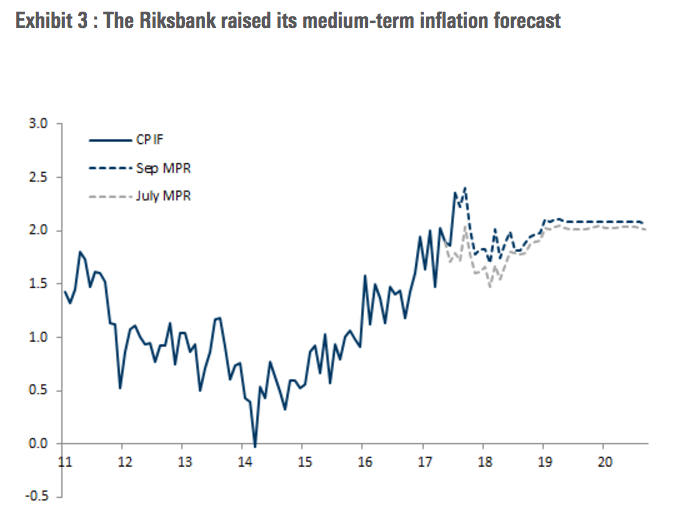

Monetary policy needs to remain expansionary for inflation to continue to be close to 2%. The Executive Board of the Riksbank has therefore decided to hold the repo rate unchanged at minus 0.50% and is expecting, as before, not to raise it until the middle of 2018.

Why is that funny? Well, because inflation has been doing pretty well. “The July inflation surprise was the fourth consecutive upside surprise relative to the Riksbank’s expectations,” Goldman reminds you in their post-mortem.

(Goldman)

Again, this is all about the krona. “It’s certainly a concern of ours,” Ingves said dryly a few hours ago.

Put simply: they are hamstrung. If Draghi doesn’t move, they can’t move and if they do, the krona would appreciate rapidly, jeopardizing the gains they’ve made on inflation. Of course in the meantime, loose monetary conditions have created a housing bubble.