BAML does not think buying bonds by the ECB will not stop anytime soon

The European Central Bank holds its next monetary policy meeting on Thursday and investors are on the look out for any signal from the bank on its plans to scale back its €60 billion bonds buying stimulus program.

Speculation that the central bank will scale back its bond buying has pushed the Euro to a multi-year high against the dollar in the past few months with the currency hitting $1.20 at the end of August, its highest level since the beginning of 2015. Analysts at UBS have recently upgraded European banks on the expectation that they will benefit from higher rates as the central bank retreats from the bond market.

ECB To Keep Buying Bonds Forever?

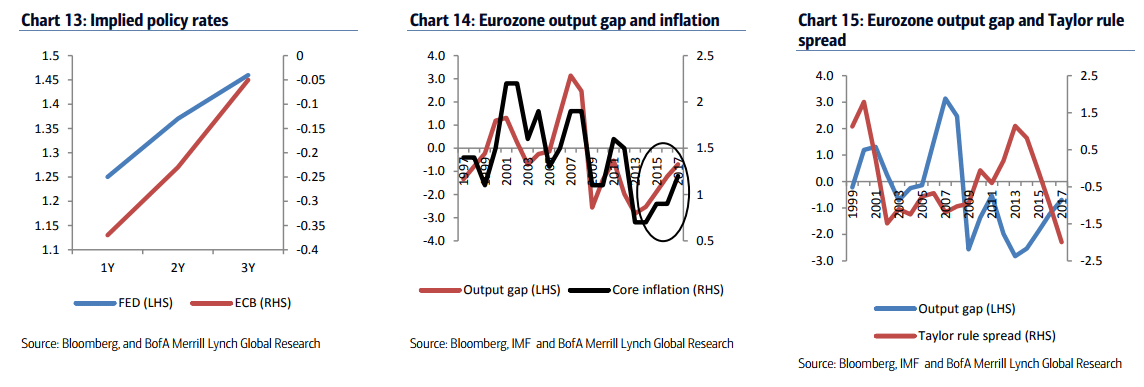

Even though the market is looking for a taper, analysts at Bank of America believe that investors seem to be expecting too much from the ECB as the bank still has plenty of flexibility in its buying bonds program and inflation targets. Specifically, headline inflation was running at a 1.5% pace in July, shy of the ECB’s target of near 2%. Why should the ECB stop its asset purchases when ” they are far from their inflation target, and they keep revising their inflation projections downwards” the bank’s global FX strategy team asks?

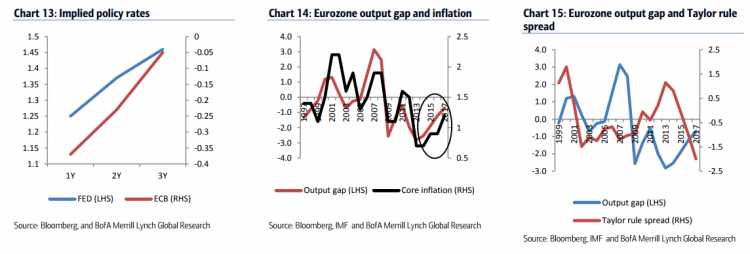

Further, the strength of the euro this year is proving to be a drag on inflation and it’s likely “the ECB will have to revise its inflation projection downwards again in September, further away from its target.” And unlike the US Federal Reserve, which has voiced concerns about rising asset prices, the ECB does not have similar concerns, so it can keep rates lower, for longer.

“We expect the ECB to have a different view on financial stability concerns than the Fed. First, Eurozone equities are not at a historic high, as in the US, and in any case the stock market is less important for the Eurozone economy, which is bank-based, than for the US economy. Second, fast ECB tightening could lead to higher periphery borrowing costs, bringing back Eurozone debt sustainability concerns and Eurozone breakup risks. Therefore, while financial stability in the US needs the Fed to lean against asset price bubbles, financial stability in the Eurozone needs then ECB to keep supporting periphery assets, or at least to avoid a sharp adjustment.”