Credit markets to stocks this week…

Video length: 00:00:06

Before we start – let’s celebrate. As @BespokeInvest notes, we’re making history today: first 12 month period in the history of the S&P 500 without a 3% drawdown. The VIX is also the lowest on the record using a rolling 12 month average.

All major indices ended the week red. This is the Dow & S&P’s first weekly loss in the last 9 weeks. Trannies were worst (worst weekly loss since July). Small Caps worst week since August.

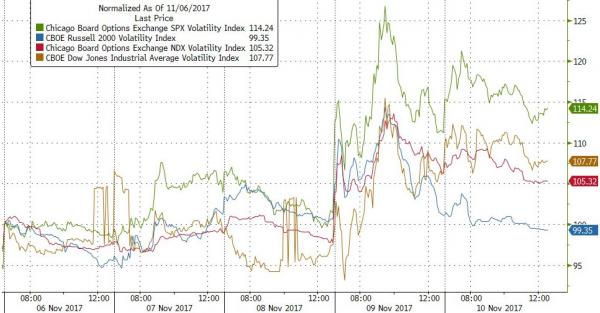

This was VIX’s biggest weekly rise in 3 months…

Russell 2000 VIX actually ended slightly lower with S&P VIX the biggest riser on the week…

Financials (green) were the week’s worst performing sector, Utes (blue) and Retailers (black) outperformed…

On the week when the government unveiled its tax plan, high tax stocks underperformed…

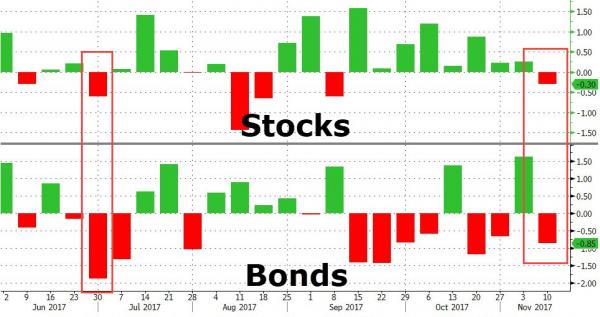

Bonds and Stocks fell on the week for the first time since June…

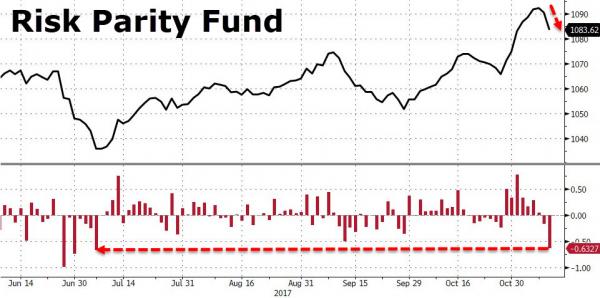

Which coincided with the worst drop in Risk-Parity funds since June…

All of which happens as a cluster of Hindebnburg Omens strikes…

Breadth in stocks remains weak…

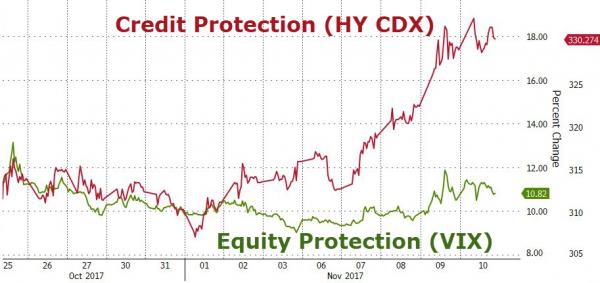

HYG (High Yield Bond prices) tumbled most in 3 months…

High Yield continues to diverge from stocks…

VIX remains suppressed…

Treasuries sold off quite hard today – notable along with the equity weakness, suggesting Risk Parity problems – as the long-end underperformed, swinging the curve steeper…

The yield curve ended the week very marginally steeper after a v-shaped bounce midweek…