Which alternative weighting scheme works best?

There’s been a whole lot of noise made about strategic or smart beta in the past few years. Strategic beta represents a sort of middle ground ‘tween passive and active investing and seems a perfect niche for exchange-traded funds. Usually, strategic beta ETFs employ a transparent, if mechanistic, methodology designed to exploit some factor or inefficiency. Their goal, like actively managed portfolios, is to outperform the benchmark, but at a much lower cost than active products.

The simplest way to obtain some excess return is to strategically reweight the market benchmark. Let’s take a look at a couple of riffs on the venerable S&P 500 Index.

The best-known version of an ETF tracking the index itself is the SPDR S&P 500 ETF (NYSE Arca: SPY). SPY’s the grand-daddy of all ETFs and hews closely to its underlying index. Its 500-stock portfolio is weighted by capitalization and costs just 9 basis points (0.09 percent) a year.

Other ETFs contain the same 500 stocks as SPY, but weight them differently. The Guggenheim S&P 500 Equal Weight ETF (NYSE Arca: RSP), as its name implies, assigns equal weight to each issue, giving full voice to the smaller companies in the index. Holding RSP will cost you 20 basis points a year. For 39 basis points, the Oppenheimer Large Cap Revenue ETF (NYSE Amex: RWL) takes the S&P 500 and reweights each stock by its company’s revenue.

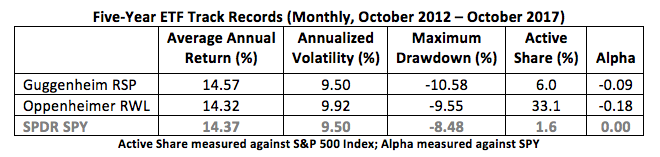

You’d expect these alternative weighting schemes to yield different performance characteristics. And you’d be right. But the differences seem fairly subtle, at least on the surface.

When considering these alternatively weighted portfolios, one has to ask if the differential results justify their higher costs. Looking back over the past five years, you’d be hard-pressed to say yes.

Five-Year ETF Track Records (Daily, October 2012 – October 2017)