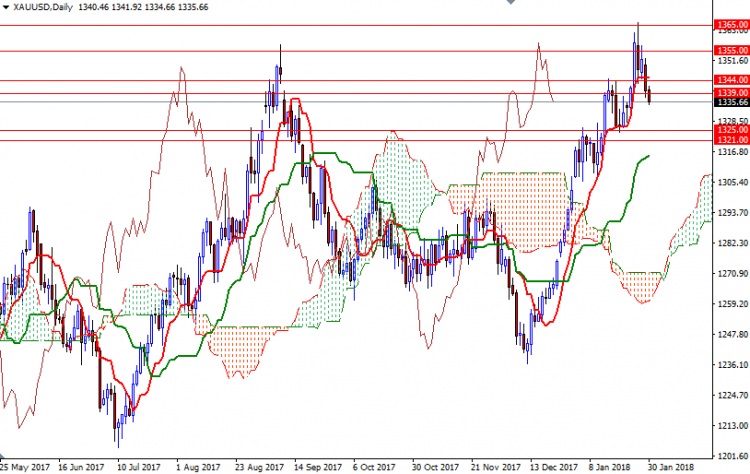

Gold prices fell $9.64 an ounce on Monday as the dollar edged up ahead of this week’s Fed meeting and U.S. jobs report. No rate hike is expected, however, markets will be focusing on the central bank’s assessment of the economy and inflation for hints on the timing of future rate hikes and policy adjustments. XAU/USD is currently trading at $1335.66, lower than the opening price of $1340.46.

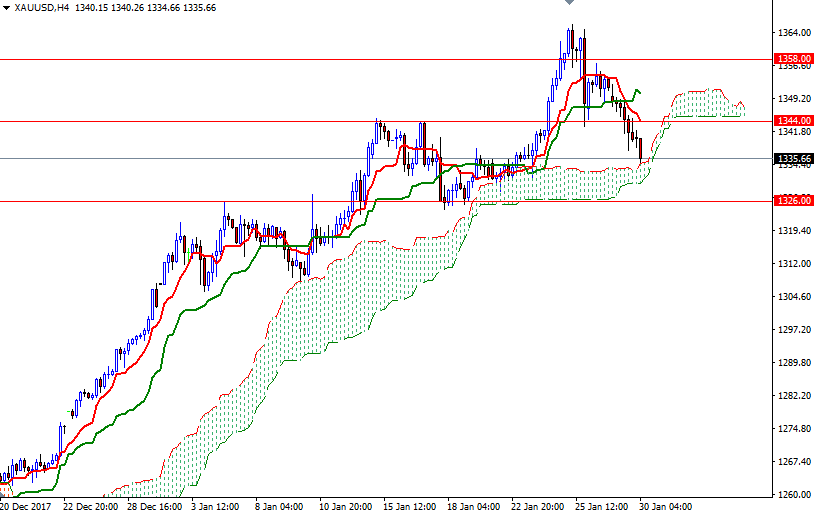

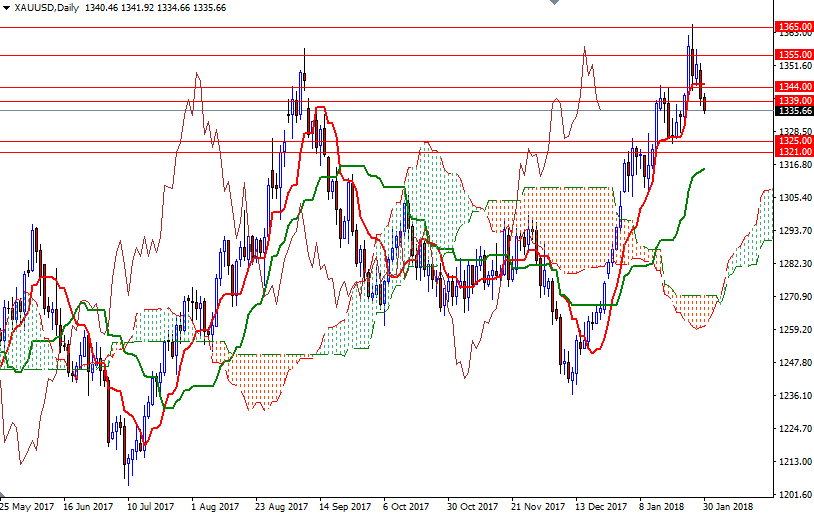

Some chart-based selling was also behind gold’s 0.71% drop yesterday. XAU/USD extended its losses as expected after prices broke 1344, and retreated to the 4-hourly Ichimoku cloud. The short-term charts are bearish at the moment, with the market trading below the Ichimoku clouds on the H1 and the M30 charts. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned, and the hourly Chikou-span (closing price plotted 26 periods behind, brown line) is below prices.

To the downside, the initial support sits in the 1334/3 zone. If the bears can pull the market below 1333, they may have a chance to visit 1329.90, the bottom of the 4-hourly cloud. A break below there opens a path to 1325. The bears have to produce a daily close below 1325 to tackle 1321. The bulls, on the other hand, will need to push prices back above 1345.50-1344 if they want to regain the control and make a run for 1351/0. Beyond there, the 1358/5 area stands out as a strategic resistance. Closing above 1358 on a daily basis implies that the bulls are on their way to 1365.