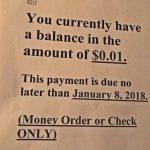

It cost more money to print this sign than what the balance due is.

Plus, cash is not an option, only check or money order.

I guess the management does not have one of those change cups by the register so that folks can put in their extra pennies to cover those who may be short by a few.

The market has a similar incongruity.

If you buy on strength, you could wind up spending more money than what the stock is worth.

If you buy on weakness and trade with smaller position sizes along with tighter stops, and the market cannot hold current levels, your cash might still have less worth than if you just wrote the market a money order or check.

In other words, as inane as it is to ask a tenant to write a check for one cent, it’s equally inane to try to navigate a choppy market.

Now, if the tenant had done his/her accounting correctly, he/she would owe nothing.

Is this a good time for active investors to settle up and go to cash?

Interestingly, on the last major correction, most concerned investors did not sell.

The major reason investors hung on, is that the sell-off was fast and furious, and the bounce that followed was just as fast and furious.

However, the bounce sent only two instruments of the Modern Family to new highs and none of the indices.

Although Nasdaq 100 came close to a new high, it stalled right below the old high at 170.95.

Semiconductors (SMH) and Regional Banks (KRE) did make new highs on Monday, yet both closed that day on their intraday lows.

Although SMH and KRE hold bullish phases, question is for how long?

The Russell 2000, Biotechnology (IBB) and Retail (XRT) all confirmed warning phases.

This morning, the Gross Domestic Product came in at 2.5%. Hardly an overheated economic situation.

This too surprised the market, especially after Powell spooked it yesterday with his optimism and statements about raising rates.

Naturally, the lukewarm GDP sent the bonds running and the rates easing.