In a previous post, I documented the fact that the Fama puzzle had transformed post-global financial crisis, so that for most currency pairs, interest rate differentials pointed in the right direction for subsequent exchange rate depreciation, from 2006 through end-2015 (Bussiere, Chinn, Ferrara, Heipertz (2018)). Here I show that the new puzzle persists through the end of 2017, a period when US interest rates were rising.

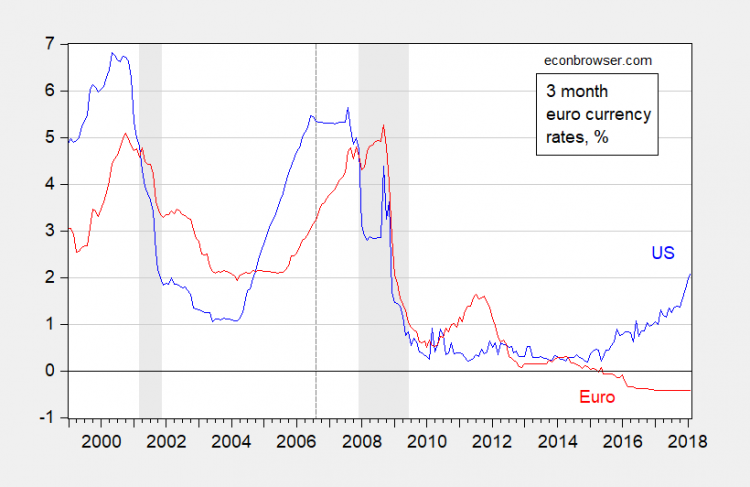

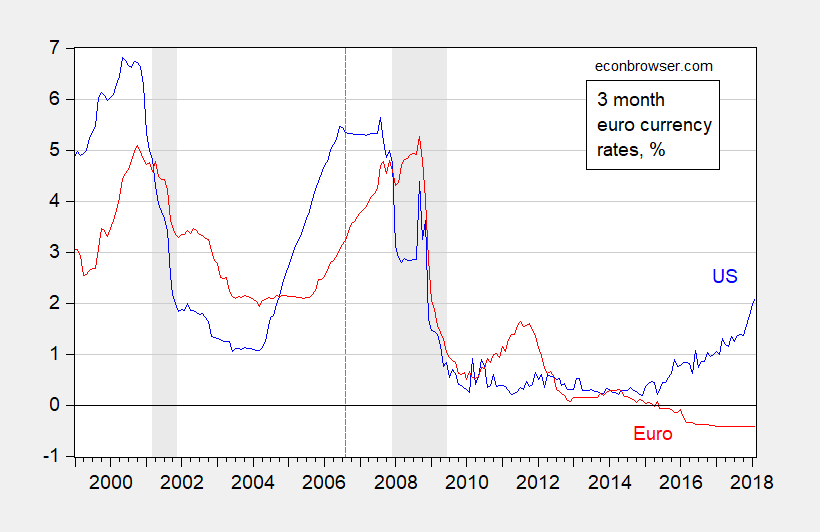

First consider three month euro-currency interest differentials (eurodeposit data from 2016M02 onward from BoE and National Bank of Belgium).

Figure 1: Three month euro-currency rates for US (blue), for euro area (red). NBER defined recession dates shaded gray. Source: Thomson Reuters thru 2016M02, Bank of England and National Bank of Belgium thereafter.

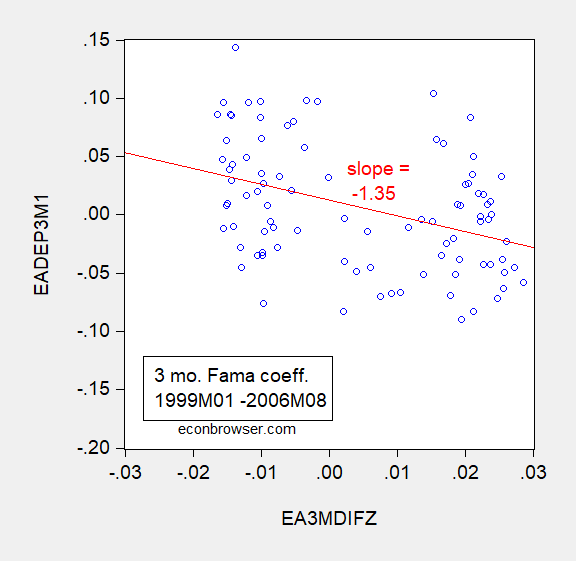

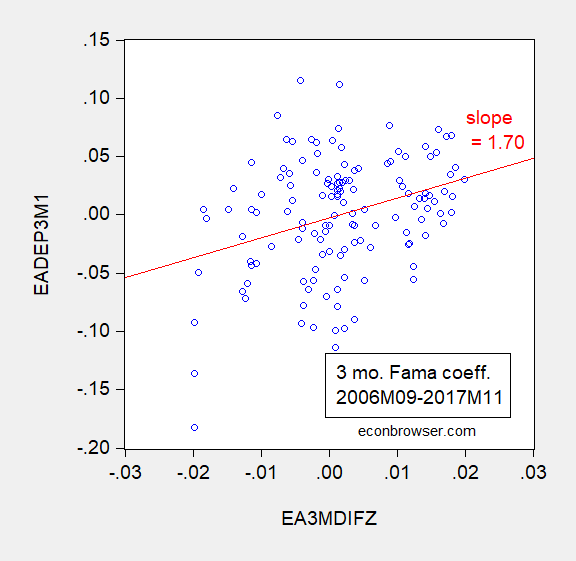

If one estimates the Fama regression,

s+1 – s = α’ + β'(i-i*) + error

breaking the sample into that up to 2006M08, and that from 2006M09 to 2017M11, one obtains the following slope estimates.

Figure 2: Three month ex post depreciation euro-dollar annualized against three month US-euro area euro-deposit interest differential, 1999M01-2006M08 (blue circle) and OLS regression line (red).

Figure 3: Three month ex post depreciation euro-dollar annualized against three month US-euro area euro-deposit interest differential, 2006M09-2017M11 (blue circle) and OLS regression line (red).

The slope coefficient is statistically significantly different from zero, but not unity. One salient question is whether the puzzle has persisted in the post-ZLB period. As we noted in our Bussiere, Chinn, Ferrara, Heipertz (2018):

… a formal decomposition of deviations from the posited value of unity in the Fama regression indicates that the switch in signs from pre- to post-crisis can be attributed to a large extent to the switch in the nature of the co-movement between expectations errors and interest differentials. This finding implies that the change in the Fama coefficients is not necessarily a durable one.