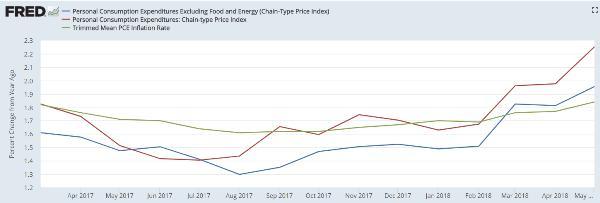

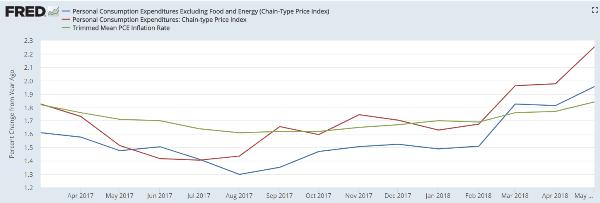

One of the reasons “data-driven” central banks are given wiggle room on their pledge to tighten monetary policy is the fact there are several definitions of inflation. In the US the thing most people think of as inflation is the consumer price index, or CPI, which is now running comfortably above the Fed’s target. But the Fed prefers the personal consumption expenditures (PCE) price index, which tends to paint a less inflationary picture. And within the PCE universe, core PCE, which strips out energy and food, is the data series that actually motivates Fed action.

And that, at long last, is now above the 2% target, having risen 2.3% in the past year.

On the following chart, the core PCE is the blue line. Note the steepening slope towards mid-year. This is clearly a trend with some momentum which, if it continues, will take this index from slightly above target to substantially above.

A more surprising above-target reading just came from Germany, which didn’t used to have inflation of any kind.

But now it does:

(Reuters) – German inflation surpassed the target set by the European Central Bank for the euro zone in June, the second month in a row it has done so, lending support to the ECB’s decision to close its bond purchase scheme at the end of the year.

Data published by the Federal Statistics Office on Thursday showed that EU-harmonised German consumer prices rose 2.1 percent year-on-year. The same measure had increased by 2.2 percent in May. The yearly figure matched a Reuters forecast.

Again, note the pop over the last couple of months. If this is sustained, the European Central Bank will have to speed up its leisurely tightening pace. Right now it’s scaling back its bond-buying but not signaling higher rates – which will definitely have to be on the menu if German inflation stays above 2%.

Emerging Market Crisis

But there’s a tricky dynamic now in play: Higher interest rates and rising currencies in the core of the global financial system cause trouble on the periphery, which then boomerangs right back to the core. Already, since the US Fed began raising rates and the dollar started rising in response, the effects have been dramatic: In just the past quarter: