Alex asked an excellent question in the Facebook group yesterday:

Besides keeping cash, would it be a good idea to switch from stocks to treasury bonds? Do bonds usually rise when the stock market crashes? Do you have data to do a study on this?

*Alex asked this question because a previous study demonstrated that the stock market will make a big top in 2019

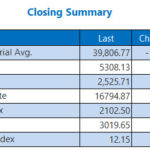

So without further ado, here’s what happened to the 10 year Treasury yield during each of the S&P 500’s 4 bear markets from 1950-present.

Here are the historical cases in detail.

October 11, 2007 – March 6, 2009

September 1, 2000 – October 10, 2002

January 11, 1973 – October 4, 1974

December 2, 1968 – May 26, 1970

Conclusion

As you can see, sometimes interest rates go up during equity bear markets. Sometimes interest rates go down. There’s no consistency.

*Interest rates move inversely with bond prices.

Hence, changing your portfolio from stocks to bonds during an equity bear market = a 50-50 bet. Personally, I would not put my money into long term bonds during an equity bear market.