Traditionally, every time 10Y US Treasury Yields have jumped solidly above the 3% level – as they have in recent days – Emerging Markets were among the first casualties. But not this time, in fact, quite the opposite as developing-nation stocks climbed for the fifth time in six days and the lira and rand led a rally in currencies.

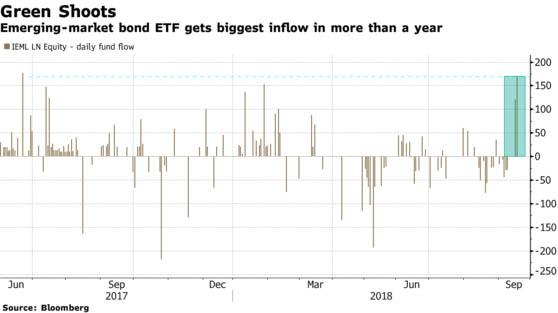

Average spreads on the emerging-market dollar and local currency bonds narrowed too. As the chart below shows, the largest ETF tracking emerging-market local currency bonds – the $6.1 billion JP Morgan IEML ETF (registered in 20 countries ex-US) – saw $169 million in inflows, the most since June 2017, after losing about a quarter of total assets since early April according to Bloomberg.

The inflows suggest that developing markets may finally be turning the corner after the worst slide in EMs since the financial crisis, as a result of a stronger dollar and global trade war.

Bizarrely, the rebound in sentiment has taken place against a backdrop of deteriorating China-U.S. trade tensions and may encourage those seeing an end to a sell-off that’s hammered asset prices from Indonesia to Turkey and Argentina during a tumultuous past five months. The EM price gains have also given strength to the bout of optimism triggered last week by interest-rate decisions in Turkey and Russia that were more hawkish than many anticipated.

EM optimism appears to be contagious among analysts: quoted by Bloomberg, Bernd Berg, a strategist at Woodman Asset Management in Zug, Switzerland said that “currencies have found a bottom for now and the tactical rally might have some room to extend further as emerging-market central banks have come to the rescue with rate hikes”, said “Overall fundamentals are still solid and valuations are cheap in some emerging-market foreign exchange after the aggressive repricing this summer”.

Franklin Templeton’s Chris Siniakov and Goldman Sachs Asset Management’s Philip Moffitt are among those who also say the declines in emerging markets are starting to ease.